The Covid-19 pandemic has caused significant disruption to the local and global fast food industry, with industry players consequently adapting to rapidly shifting market conditions, in order to survive. As part of efforts to find a cure for the economic effects of Covid-19, the concept of ghost kitchens is taking hold, both locally and globally. This innovative concept is providing opportunities for cash-strapped fast food companies, as well as smaller players, to save costs by sharing production facilities, and having their food delivered to consumers.

Insight Survey’s latest SA Fast Food/QSR Landscape Report 2020 carefully unfolds the global and local fast food markets based on the latest information and research, including the impact of Covid-19. It examines the relevant global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African fast food industry environment and its future.

Globally, the fast food market was valued at approximately $847bn in 2019. The market is expected to grow at a compound annual growth rate (CAGR) of 4.5% (previously 5.6%), for the forecast period 2020* to 2026*. This forecast includes a decline of -5.0% in 2020, due to the impact of the Covid-19 global pandemic.

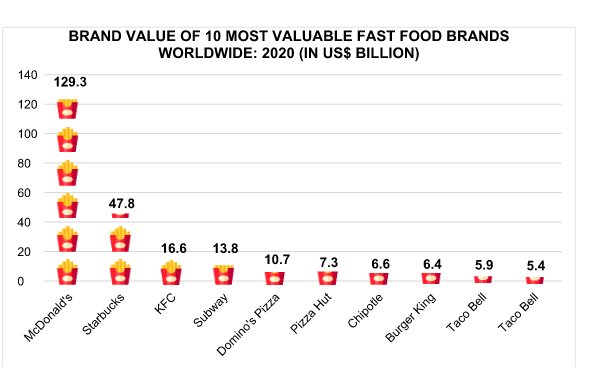

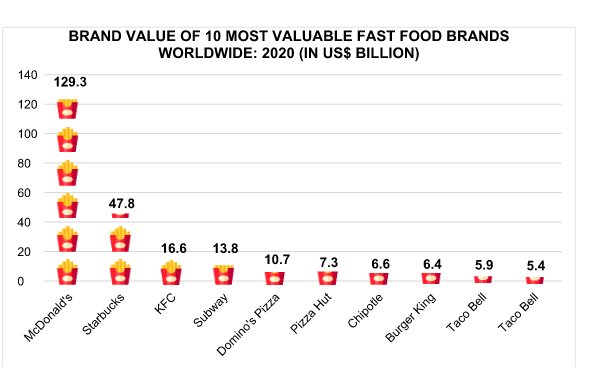

As illustrated in the graph below, McDonald’s is considered to be the most valuable fast food brand in 2020 globally, with a brand value of $129.3bn. This is followed by Starbucks and KFC with brand values of $47.8bn and $16.6bn, respectively.

Source: Kantar. Graphics by Insight Survey Similarly to previous years, the predicted growth of the South African fast food industry is lagging behind that of the global industry, due to several ongoing challenges, with the market predicted to experience marginal growth between 2020 and 2024. This includes a sharp decline in 2020, due to the impact of the Covid-19 pandemic on the South African economy.

As a result, along with global players, South African fast food companies are embracing the ‘ghost kitchen’ concept, where multiple chefs from different brands can operate in a centralised kitchen. This allows for significant savings in terms of facilities, as these locations do not have any dine-in capacity, with the food only being sent out for delivery.

As an example of local ghost kitchens, Smart Kitchen Co., which is South Africa’s largest ghost kitchen provider, is currently offering shared kitchen facilities to South African fast food companies, hosting 15 online restaurants that operate from five different physical locations. Some of the companies making use of these facilities include up and coming players such as King Chicken, Jazzy’s Pizza and Quick Convenience, amongst others.

Moreover, companies, such as Cape Town-based Darth Kitchens, are also producing their own brands through their own virtual kitchen, instead of simply facilitating other existing brands. In particular, the company is offering their innovative ‘ninth-slice’ pizza product, coming with nine slices of pizza, instead of the traditional eight, positioned towards consumers looking for extra value.

Additionally, home delivery services, such as Uber Eats and Mr Delivery, are continuing to drive growth of the South African fast food market. This distribution channel has taken on even greater significance during the national lockdown, with these delivery services allowing for players to continue to operate, even as consumers have been confined to their homes. This has provided a lifeline to the industry, particularly smaller independent players, struggling to survive.

As the local fast food Industry continues to grapple with the economic effects of the Covid-19 pandemic and lockdown, there will be a continuous need for industry players to innovate, in terms of production and distribution of their fast food products. As such, ghost kitchens and home-delivery services are serving as key drivers for the industry, during these turbulent times.

The South African Fast Food/QSR Industry Landscape Report 2020 (159 pages) provides a dynamic synthesis of industry research, examining the local and global fast food industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – from key global and South African market trends, innovation and technology, drivers and challenges as well as manufacturer, distributor, retailer and pricing analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global fast food industry?

- What are the key global and South African fast food industry trends, innovation and technology, drivers and challenges?

- What are the value and volume trends in the SA fast food market (2014-2019) and forecasts (2020-2024), including the impact of Covid-19?

- Who are the key players and what are the latest marketing and advertising news for the key fast food competitors?

- What is the pricing and recent promotions of key fast food competitors by category: burgers, chicken, pizza, pies and others?

Please note that the 159-page report is available for purchase for R30,000 (excluding VAT). Alternatively, individual sections can be purchased for R12,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: South African Fast Food/QSR Industry Report 2020

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 13 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.