The 4th edition of Scopen's Agency Scope UK 2021/22 has been released. A research study that highlights key trends in the UK's communication, marketing, procurement and advertising industry, and provides in depth positioning and competitive information to both creative and media agencies.

This study takes place biennially in ten other markets around the world (Argentina, Brazil, Chile, China, Colombia, India, Mexico, Portugal, South Africa and Spain), which enables the inclusion of global benchmarks in some key aspects. This UK edition was developed by Scopen in partnership with WARC and with participation of ISBA members.

The universe of analysis is comprised of the highest-level decision-makers in marketing, communications, advertising, and procurement, from the largest and most important companies in the UK. Professionals interviewed in each company had to be involved in and interact in the decision-making process for selecting and approving their agencies’ work on an on-going basis. Over 300 client-agency relationships and 141 marketing professionals were analysed.

Each year as a result of the studies taking place in the various markets, SCOPEN gathers more than 3,000 opinions globally from interviews with CMOs.

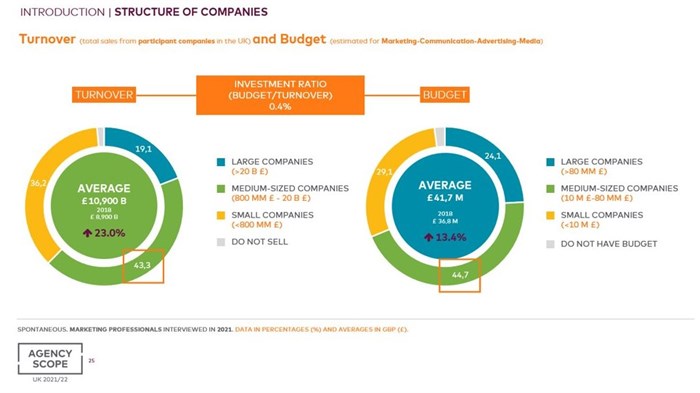

Higher turnover and marketing budgets than in 2019

The average company turnover declared by respondents is £10.9 billion (B), while the average company marketing budget declared is £41.7 million (M). In both indicators, companies have declared higher figures than in the previous edition. Marketing and communications budgets represent 0.4% of the total of companies' average turnover.

Digital investment increases more than 18% since 2015

37.5% of marketing’s budget is invested in above-the-line actions, 21.8% in below-the-line actions and 40.7% in Digital (it has increased 18.5 percentage points since 2015). Digital is, for the first time in this study, the discipline that has received the largest investment of the marketing & communications’ budget. Digital budgets in the UK are higher when compared to most of the markets in which AGENCY SCOPE is conducted (40.7% vs. 35.7% average investment from the ten market-benchmark).

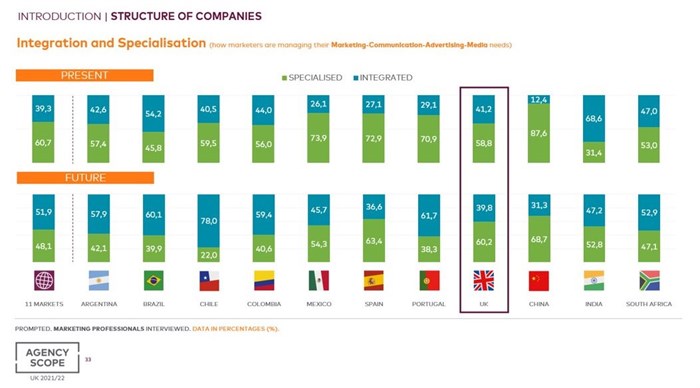

UK marketers prefer specialisation vs. integration

58.8% of marketers mentioned that they work with different agencies, specialists in different disciplines. 60.2% of respondents declared that, in the future, they would prefer to work with specialist agencies that would solve their needs in different territories, while the other 39.8% stated they would prefer to work with an integrated agency to solve all their marketing and communication needs under one roof.

UK is above the global benchmark in terms of the desire to work with specialist agencies in the future and, globally, we notice two different trends: one going towards the search for integrated agencies (Argentina, Brazil, Chile, Portugal and South Africa) and another going towards specialists (Colombia, Mexico, Spain, UK, China and India).

Johanna McDowell, partner for Scopen in the UK and South Africa and CEO of the IAS (Independent Agency Search & Selection company), says “These results are a good indication of trends that are happening globally in the advertising sector and it will be interesting to see how these compare with the results of the Agency Scope study in South Africa in 2021 where results are due in October this year.”