Subscribe & Follow

Are 'better-for-you' options helping to beat SA's breakfast cereals market crunch?

Insight Survey’s latest South African Breakfast Cereals Industry Landscape Report 2022, carefully uncovers the global and local breakfast cereals market, based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African breakfast cereals industry environment and its future.

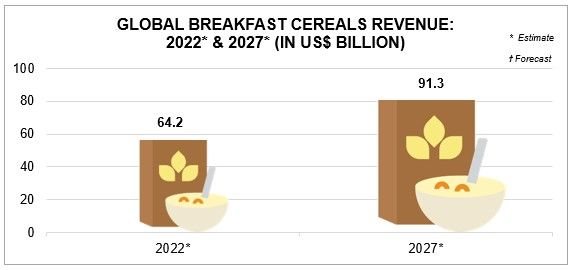

In 2022, the global breakfast cereals market is estimated to generate revenue of approximately $64.2bn. Furthermore, the global breakfast cereals market is forecast to increase at a compound annual growth rate (CAGR) of 7.3%, to reach approximately US$91.3 billion by 2027, as illustrated in the graph below.

In terms of the local market, one of the key factors driving growth is the ongoing high levels of cereal production in South Africa, which ensure adequate stock and acceptable prices. This includes maize and wheat, which are crucial ingredients in some of the nation’s most popular breakfast cereals, such as ProNutro Original, and Weet-Bix Original, amongst others.

Globally, the demand for healthier breakfast cereal options has resulted in the launch of a variety of new healthy breakfast cereal products, with wide-ranging health benefits, including being high-protein, high-fibre, vegan, gluten-free, low sugar, plant-based, and GMO-free.

Notable global healthy breakfast cereal product launches over the past year have included Brave Super Hoops, a new line of high-protein products, as well as Eleet, which is a line of high-protein and fibre, vegan, and gluten-free cereal, both of which were launched in the United Kingdom. Other products included the functional muesli product, Guud Fuel, as well as Ready, Set, Food! Organic Baby Oatmeal, which is designed as an organic early allergen introduction product.

This trend has made its way to the South African market, with a recent academic study indicating that the nutritional profile of breakfast cereal products has become significantly more important when compared to factors, such as taste, to consumers. Additionally, leading brands are continuing to advertise the inclusion of vitamins, minerals, iron, multigrain, fibre, and even probiotics in its products to appeal to more health-conscious consumers.

Players attempting to capitalise on this ‘better-for-you’ trend include Futurelife, which recently launched a new wholewheat porridge, Futurelife Smart Food Wheat, which contains 50% less sugar than competing brands. The brand also launched a new breakfast cereal range for kids, which claims to support growing bodies with essential vitamins and nutrients and contain 40% less sugar.

Furthermore, Truda Foods introduced its new MyLife + Super Cereal to its MyLife wholegrain range, which contains 13% protein, is low in sugar, and is formulated using the World Food Programme guidelines. Additionally, this new breakfast cereal is high in dietary fibre and energy and contains added vitamins and minerals, including vitamins A and D.

This trend has even extended into the cereal bars segment, with the launch of a new range of nutritious cereal bars by a major local brand, Jungle. This range is positioned as a healthy on-the-go snacking option for local consumers, that are relatively low in sugar compared to competing brands, and contain real fruit and nuts, as well as being made up of more than 30% oats.

Finally, proving that not only is local ‘lekker’, but also healthier, locally-grown cereal crop, sorghum, also hailed as a superfood, has been cited by experts as having big potential in terms of new breakfast cereals products. This is particularly in terms of sorghum malt, which can be used to produce malted sorghum breakfast cereal and Ready-To-Eat snacks.

The South African Breakfast Cereals Industry Landscape Report 2022 (132 pages) provides a dynamic synthesis of industry research, examining the local and global breakfast cereals industry from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as manufacturer, distributor, retailer, and pricing analysis.

Some key questions the report will help you to answer:

- What are the key market dynamics of the global and South African breakfast cereals industry?

- What are the latest global and South African breakfast cereals industry trends, innovation and technology, drivers, and challenges?

- What are the market value and volume trends in the South African breakfast cereals industry (2016-2021) and forecasts (2022-2026)?

- Which are the key manufacturers, distributors, and retail players in the South African breakfast cereals industry?

- What is the latest company news for key players in terms of products, new launches, and marketing initiatives?

- What are the prices of popular breakfast cereals brands and products across major South African retailers?

Please note that the 132-page report is available for purchase for R35,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R15,000.00 (excluding VAT). For more information, please email info@insightsurvey.co.za, call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For a full brochure: South African breakfast cereals Industry Landscape Brochure 2022.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions, to help you to successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment, through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.

- Made for you: Tailored solutions driving growth of SA’s long-term insurance industry26 Feb 11:55

- Claiming the future: AI’s role in SA’s short-term insurance industry27 Nov 16:13

- Star power and celebrity endorsements fuel South Africa’s sports and energy drinks boom27 Nov 14:04

- Packaging innovations seal the deal in South Africa’s bottled water market25 Nov 14:03

- South African fast food market’s taste for technology driving growth04 Sep 09:57

Related

Claiming the future: AI’s role in SA’s short-term insurance industry 27 Nov 2024 Star power and celebrity endorsements fuel South Africa’s sports and energy drinks boom 27 Nov 2024 South African fast food market’s taste for technology driving growth 4 Sep 2024 Are functional vitamins enhancing South Africa’s vitamins industry? 26 Jun 2024 Are topical products helping to boost South Africa’s analgesics market? 19 Jun 2024 Are innovative formats driving South Africa’s allergy care market? 12 Jun 2024