Subscribe & Follow

#AfricaMonth

In the news

Understanding today's omnishopper

While this omnichannel approach presents myriad opportunities for consumers, it can be challenging for retailers, particularly because no two consumers – or categories – have the same omnichannel profile. So to succeed in today’s environment, retailers and manufacturers need to be aware of the consumer path to purchase across all channels, including online.

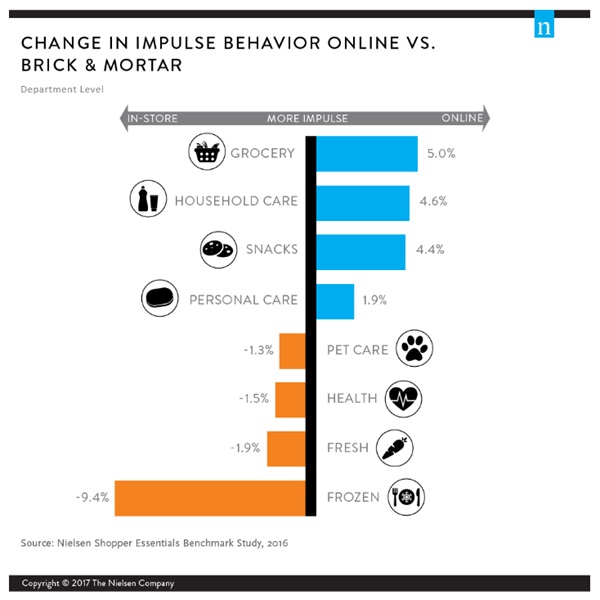

In a recent study into U.S. omnichannel shopping, Nielsen uncovered several insights around impulse shopping. For example, while many might assume that impulse purchases happen more often in physical stores than online, there are several categories where online impulse shopping outpaces those in brick-and-mortar environments.

Specifically, consumers make more online impulse purchases across the grocery, household care, snack and personal care categories than they do at brick-and-mortar stores. In fact, U.S. consumers are 5% more likely to make an impulse purchase in the grocery category online than in a physical store. This doesn’t mean, however, that online shopping is a breeding ground for impulse shopping. There are many categories where impulse shopping is more common at physical stores, including frozen food, which consumers are 9.4% more likely to buy on impulse in-store than online.

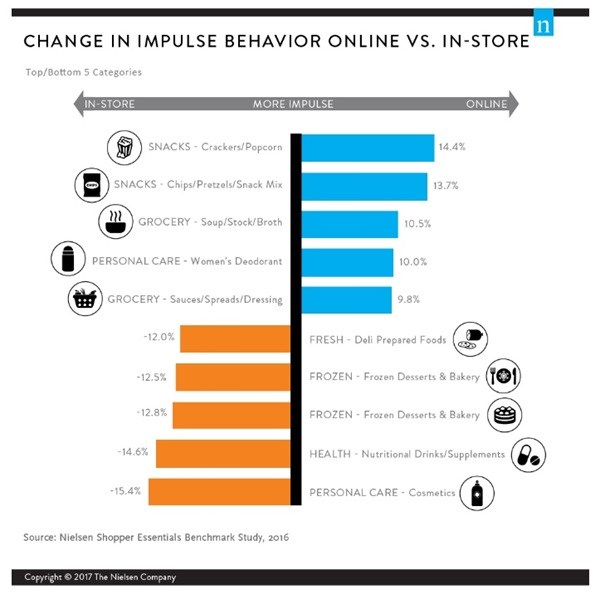

While overall trends at the department level are important, these omnichannel insights become more actionable at a category level. Some categories retain their impulsivity online, but drilling down into department-level insights highlights that some categories see impulse purchases swing in either direction. To underscore the importance of specific, granular shopper insights, category-level information will help retailers and manufacturers assess the true opportunities that exist in their categories, and more importantly, how to act on them to benefit sales.

In looking at the chart above, it’s clear that certain categories are more likely to spark impulse buys that others. Deli prepared foods, for example, are significantly less of an impulse buy online than in-store, likely due to the fact that in-store shoppers are typically looking for something convenient that they will eat soon. Convenience is an important driver for an array of categories that cannot be easily replicated online.

Retailers looking to win with omnichannel opportunities know that offline behaviour doesn’t necessarily translate online. For retailers and manufacturers, understanding consumers, including where they shop and why, is vital part in understanding the complete consumer path to purchase.

Source: Supermarket & Retailer

Supermarket & Retailer brings wholesalers, retailers and suppliers the latest industry news, store trends, merchandising, promo ideas and operating efficiencies in its monthly printed publication, Equipment & Services Buyers Guide and website.

Go to: http://www.supermarket.co.za/news-current.aspRelated

Boomers to Zoomers: how retailers and e-commerce firms can boost sales and loyalty 20 Nov 2024 Insights into the Gulf Cooperation Council, UAE and Saudi Arabia shopping behaviour 4 Sep 2024 Dion Chang outlines shifts and trends impacting SA's retail industry 15 Aug 2024 Consumers shift their online buying behaviour 13 Aug 2024 What are SA shoppers spending money on in 2024? 8 Apr 2024 90s and 2000s nostalgia is shaping consumer choices 27 Mar 2024