Subscribe & Follow

#AfricaMonth

Jobs

- Brand and Marketing Manager Johannesburg

- CRM and Lifecycle Manager Cape Town

- Content Marketing Manager Cape Town

- Marketing Analyst George

- Spier Brand Manager - Wines South Africa Stellenbosch

- Model Booker Cape Town

- Marketing Coordinator Cape Town

- GRC Implementation Consultant (Risk Management) Johannesburg

- Financial Administrator Cape Town

- Senior Campaign Mananger Cape Town

In the news

How did Covid pre and post affect what channels consumers consume?

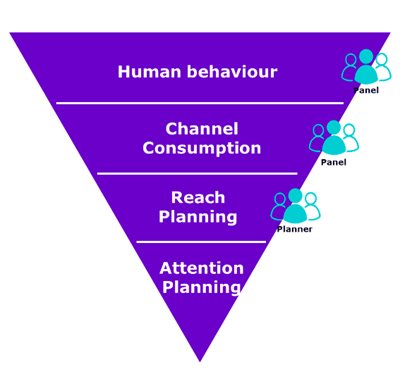

At a recent dentsu panel for the 2022 Loeries, Professor Karen Nelson-Field said: “[t]hings went bad when we stopped measuring outward and started measuring inward.” CCS enables us to measure 'outward' by building a clear and rich understanding of human behaviour. This, layered with channel consumption and effective reach planning, provides the base from which we work at dentsu, and the base from which we can springboard into key industry discussions such as the evolving conversation around Attention Planning.

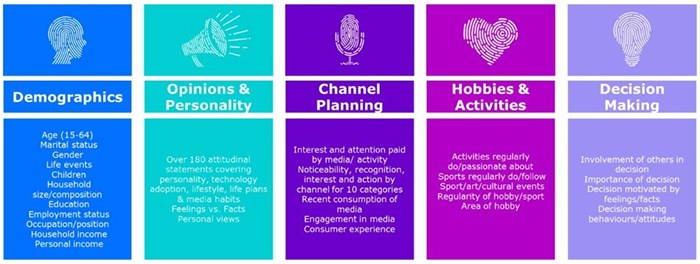

CCS is one of the most robust audience data systems we have available to us in South Africa, covering key data points:

- Demographics

- Opinion and personality

- Channel planning

- Hobbies and activities

- Decision making

With over 180 attitudinal statements, we can look at in-depth channel understanding including reach, recognition and attention paid, as well as key decision-making behaviours and attitudes. CCS therefore provides the ideal starting point for key business, communication, and media decisions.

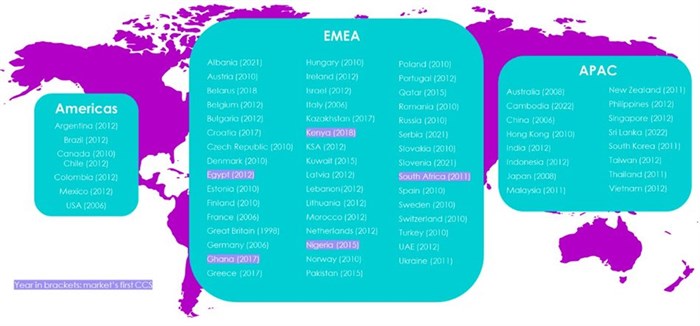

The system is an incredibly well-established method of understanding people, with the first CCS debuting in the United Kingdom over 24 years ago.

In South Africa alone, CCS has been in market for over a decade, consistently evolving and adapting to suit the rapidly changing needs of our industry.

In 2020, as the world went into lockdown, the South African dentsu team began collecting and collating audience data. This enabled us to have a complete data-led understanding of human behaviour during Covid-19, and with the launch of our 2022 CCS, we now have comparable human understanding pre, during and post Covid enabling us to create clear pictures of who our audiences are, why they are the way they are, and how we can best motivate and reach them.

Our 2020 and 2022 data collections were made possible by our partner Borderless Access who provided access to a well-established panel with over 300k respondents, available online and across SEMs and cities, towns, and rural areas.

With more consumers coming online, we’ve seen our CCS audience size expand. As of 2022, we now have representation of 29,015,000 adults made up from a sample size of over 5,000.

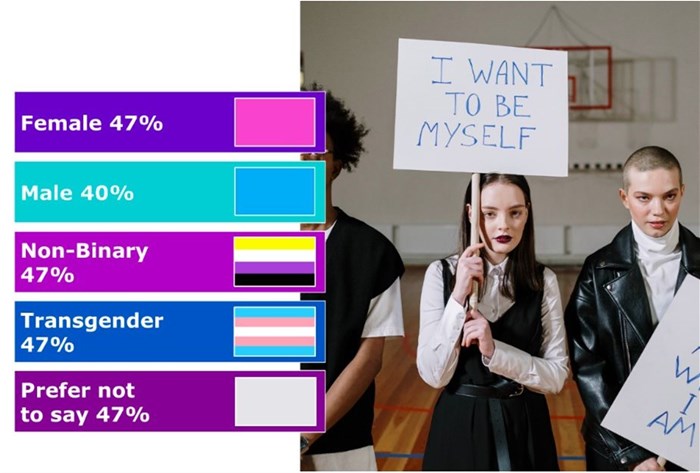

The shift to online has had additional benefits such as more authentic and honest responses, particularly around sensitive questions pertaining to income and gender identity. Demographic data also unlocks additional insight around key human circumstance in our country. The latest data indicates that over 6m people, 1.6m of them between the ages of 18–24, are unemployed. This knowledge facilitates conversation around how brands can begin to build communication and products that provide utility around key consumer pain points. For example, 39% of our total audience is looking to start a business in the next 12 months creating a significant opportunity for many brands.

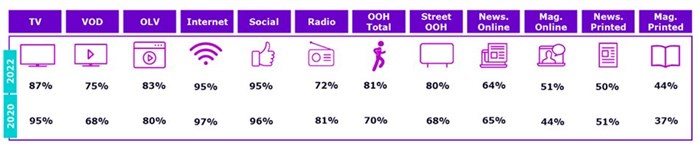

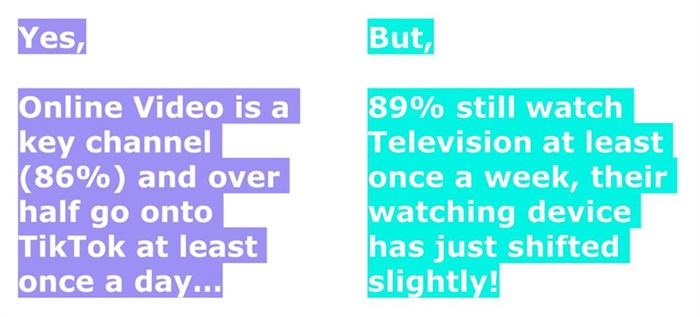

We’ve also been able to solidify our media penetration understanding even further and can now compare during Covid-19 and post Covid-19 media consumption levels. As we expected, we’ve seen a significant increase in the consumption of online video and video-on-demand, however we’ve seen a normalisation occur across television, radio and social media. Both OOH and print have recovered significantly.

The depth of CCS enables our understanding to go a step further and overlay claimed media consumption with claimed media attention, enabling a richer understanding of which channels will have significant impact against your segment. We see the most claimed attention paid to audio-visual channels, including television.

There have also been some amazing breakout channels in 2022. TikTok is now checked by 45% of our total audience at least once a day, gaining significantly on well-established platform, Instagram, that sits at 46%. Another key shift has been in gaming consumption, increasing by 23% between 2020 and 2022 to 69% weekly penetration across all devices.

On top of robust quantitative measures, CCS also facilitates our understanding across softer measures such as key behaviours and psychographics. One of the biggest changes we noticed is with the shift between the top psychographic statement, as seen below.

And lastly, one of the most exciting changes to our 2022 CCS panel has been the inclusion of people between the ages of 15 and 17. This means that we now have detailed audience data around a key segment, Gen Z (18–24-year-olds). Our audience size against Gen Z sits at a strong, 6,116,156 and we’ve already been able to unpack key differentiating factors between them and our broad audience.

Having this data on hand also creates an opportunity for us to sense check our decisions around this audience using data to back us up. Rather than making decisions based on how we feel this audience behaves, we can make informed decisions based on how we know they behave. This is particularly important when it comes to making sound media decisions for Gen Zs.

As thought leader, Bob Hoffman says: “It comes down to human intelligence and creativity, not the amount of data you have. The differentiator is the human element.” CCS equips dentsu with the right data to ensure our decisions are sound, but it is the talent across dentsu that uses this data to create magic for a brand.

Currently CCS is available to our clients, but if you are not a client, we are still able to assist you with the report; just connect with us and let’s see how we can help you plan your tomorrow. Also ask yourself this – why do we not already have access to CCS?

- Dentsu Mozambique’s Sylla Faruk named among Top 30 Women Shaping Comms in 202524 Apr 12:02

- Carni Wilkens appointed chief growth officer at dentsu South Africa14 Apr 10:56

- Ezra Ndolo promoted to managing director, dentsu Tanzania01 Apr 08:26

- Dentsu and SAB unlock smarter, AI-powered YouTube buying with Google’s VRC20 Mar 12:00

- Dentsu Creative scores second win under Pepkor umbrella with FoneYam19 Mar 10:55