Stronger global trade is expected this year and as reported by the World Trade Organisation (WTO), indicators like export orders and container shipping are on the rise at the beginning of 2017. Recognising the uncertainty on economic and policy developments, the WTO has still forecasted overall expansion in global trade.

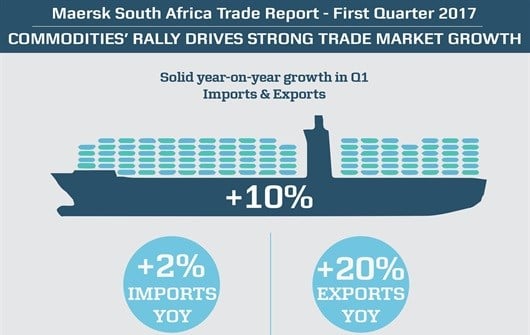

Ongoing economic uncertainty is also seen in South Africa over recent months. While this has made for a turbulent start to 2017 within many sectors, the country’s container market has shown solid growth across both imports and exports during the first quarter, resulting in strong year-on-year growth of 10%.

For Maersk Line Southern Africa, a member of A.P. Moller-Maersk, the majority of growth witnessed in the first quarter of 2017 is a result of strong mining commodity export growth. “After a 2016 downturn in the mining and mineral resources sector, commodity prices have recovered significantly through April, resulting in South African container exports showing year-on-year growth of 20%,” says Jonathan Horn, managing director of Maersk Line Southern Africa.

South Africa's largest export corridor

He explains that Asia exports grew by 37% year-on-year over the first quarter, on the back of growing demand for local mining commodities. Asia is South Africa’s largest export corridor, making up around 45% of total exports. “Commodities such as chrome and manganese are used in various products, from household appliances to road and building construction, so the global consumer demand, as well as infrastructure, spend – particularly from China due to plans around building a modern-day version of the ancient Silk Road – have helped boost the demand for South African mining commodities. The growth has also been supported by a move in some instances from bulk to containerised flows.”

Demand for mining commodities may have picked up early this year but commodity volatility is also expected throughout the year. Recently, chrome demand has dropped significantly, while manganese demand has increased. According to Horn, “Commodity demand generally follows short volatile cycles and, as commodity prices have recently decreased significantly – a reflection of lower demand – market growth for the rest of the year, while difficult to predict, is expected to be lower, in the 2-4% range.”

Refrigerated container exports

Refrigerated exports recorded growth of about 7% compared to the first quarter of 2016, which Horn says is a reflection of a robust grape crop and strong demand in Europe for South African grapes. “Looking forward, the citrus crop, which represents more than 50% of South Africa’s refrigerated container exports, is expected to grow by 5-7% on the back of strong crops in the North, while crops from the Eastern Cape will likely decline.”

Looking specifically at imports, which represent 56% of total container flows, Horn says that while the market has grown by 2% year on year, it is still slightly lower than the 2013 level which represented significant growth. “Import growth in 2016 contracted by around 5% and the market has essentially rebounded from this poor performance. Import growth in the first quarter has been stronger than expected. This is linked to a more favourable rate of exchange that has made imports more affordable and allowed businesses to restock inventory at an affordable level.”

While this is a positive development, Horn says that only growth over a longer period will signify sustainable rebound on consumer confidence and purchasing. “There is no clear evidence that consumer spending is on a sharp rise, and thus 5% growth is not likely to continue. Rather, a slightly lower 1-3% container import growth can be expected for the rest of year.”

South Africa container market up and down market swings

Along this same thread, Horn concludes that despite this quarter’s promising overall trade results, he is cautious about being too optimistic, given that significant up and down market swings are common in the South Africa container market in recent years.

“Despite the strong year-on-year growth of 10%, the 2017 market size is only 5% larger than the 2013 market size, which means the long-term growth has only been around 1% per annum in the last five years. Until a significant upward swing is seen in local consumer spending as well as consistent mining commodity demand from China, the market growth is likely to be in the low single digits for the rest of the year.”