The Professional Provident Society (PPS), the University of the Witwatersrand and Professor Jannie Rossouw, the Head of the Wits School of Economic and Business Sciences (SEBS) released the results of South Africa's first comprehensive inflation survey on 21 November 2014. This inflation survey builds on earlier research conducted by Rossouw on perceptions of historic inflation figures.

"This is the first South African survey in which the same respondents were requested to provide their perceptions of the accuracy of past inflation figures and their expectations of future inflation figures," Rossouw said. "The results indicate the degree in which perceptions of past inflation anchors inflation expectations."

The linkage between past inflation and future inflation is important for monetary policy purposes under a system of inflation targeting as is followed in South Africa. Inflation targeting works best when past inflation anchors inflation expectations.

PPS included the inflation related survey questions in its October 2014 quarterly survey conducted among its South African graduate professional members and will continue to do so in future. "This will ensure survey results providing dense and rich data that will be used extensively in academic research in future," Rossouw said.

"The quarterly surveys are distributed among PPS members," Gerhard Joubert, Executive Head Group Marketing and Stakeholder Relations at PPS, explained. "It is an electronic survey completed by respondents and therefore free from any possible enumerator bias of influence."

PPS received 3,474 responses from its members, which makes it a large data sample, albeit not a representative sample of a cross-section of the South African population due to PPS' graduate professional membership. It is also important to note that these responses are individual responses of participants and cannot be viewed as "household data," as similar surveys are often incorrectly described.

In accordance with international survey practices, respondents were provided with statements on past inflation and on future inflation. Participants were requested to choose from five possible answers to each question.

Questions

In the first question, respondents were requested to respond by choosing one of the five responses below to the question: "Over the past five years prices increased by on average 5.5% per year. During 2013 prices increased by 5.7%. In your view by how much did prices increase during the past 12 months?"

| Responses | % | | 1. Much more rapidly | 494 | 14.2 |

| 2. More rapidly | 2137 | 61.5 |

| 3. The same rate | 723 | 20.8 |

| 4. A lower rate | 103 | 3.0 |

| 5. A much lower rate | 17 | 0.5 |

| Totals | 3474 | 100.0 |

Percentage

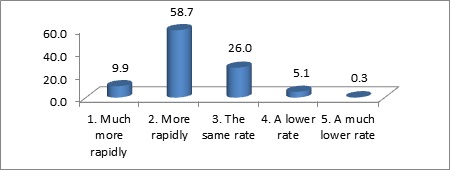

In the second question, respondents were requested to respond by choosing from the same five responses to the question: "By how much do you expect prices in general to increase during the next 12 months?"

| Responses | % | | 1. Much more rapidly | 344 | 9.9 |

| 2. More rapidly | 2040 | 58.7 |

| 3. The same rate | 904 | 26.0 |

| 4. A lower rate | 176 | 5.1 |

| 5. A much lower rate | 10 | 0.3 |

| Totals | 3474 | 100 |

Percentage

An analysis of individual responses of each of the 3,474 respondents is shown in the cross tabulation between Questions 1 and 2 in Table 1. "The cross tabulation shows the likelihood of respondents recording an expectation of inflation corresponding with their perception of past inflation," said Rossouw.

The analysis shows that 88.5% of the 494 respondents who have a perception of past inflation increasing much more rapidly than the official rate of inflation does, also expect future inflation to be above the current rate of inflation. Likewise, 77.5% of the 2 137 respondents who have a perception of past inflation increasing more rapidly than the official rate of inflation does, expect future inflation to be above the current rate of inflation. The implication is that 68.8% of respondents expect future inflation to be above the current rate of inflation.

In future, the publication of the quarterly PPS/Jannie Rossouw/WITS School of Economic and Business Sciences Inflation Survey will provide the South African Reserve Bank with an additional tool to assess the public perceptions of inflation in its monetary policy deliberations.

"PPS is excited to be part of this new research initiative. We look forward to future survey results to expand the data base, thereby increasing scope for analytical research based on these findings," concludes Joubert.