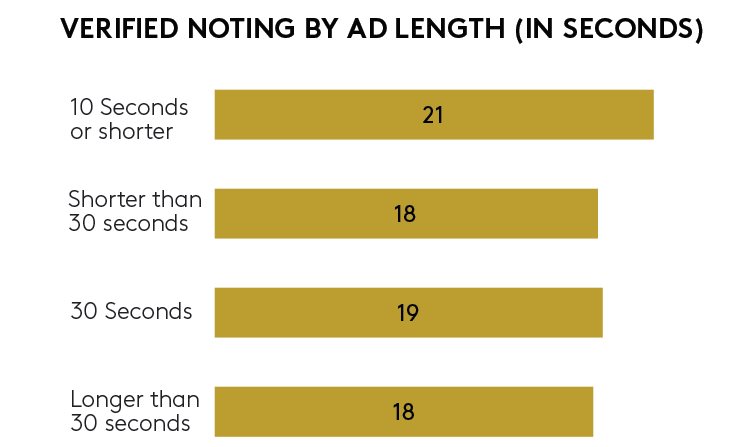

Across 6000+ adverts in the Adtrack database, there is no difference in cut-through (spontaneous ad recall – known as verified noting) between 30 second ads and longer ad lengths. Our learning’s show that 300 – 400 ARS are needed to establish launch campaigns (3 weeks post first flighting). This is regardless of ad length. The media cost of a launching a 45 second ad is considerably higher than a 30 second ad and this may affect the in-market cut through of new campaigns as sometimes brands can’t afford to launch with sufficient media weights due to the cost implications of longer durations. From a media cost perspective 30 second ads continue to be the most effective duration to launch/flight with and can introduce some efficiencies and cost savings (ROI).

From our Link database (copy testing) we know that longer adverts (30 seconds plus) have the ability to communicate more messages as well as allow very emotional adverts time to tell the story. The most important part of the advert (where the brand links to the main message and most memorable part of the ad – known as the creative magnifier) is key in driving any cut-through – regardless of ad length. Using the creative magnifier in cut downs, can help brands stretch their media budgets (we see some great examples of the 15 second cut downs being used effectively). Bottom line is that no matter the length of ad, or the investment behind it, a poor creative will hinder an ads in market performance every time.

A poor creative will still perform poorly in market, regardless of how many consumers your media plan manages to reach. Having a look at the last 374 adverts tracked at launch, the chart highlights the fact that there is no correlation between reach and above average cut through (spontaneous verified noting). There is a plethora of adverts with very high levels of reach and very little cut through, which points to poor/weak creative. There is also a multitude of adverts which have above average noting (but very little exposure), pointing to lack of media investment at launch. Both scenarios highlight a missed marketing opportunity! The Kantar advertising philosophy is simple. A cut-through campaign consists of two crucial elements: sufficient investment to drive exposure within the core target audience; and stand-out creative to drive brand engagement and communicate core messages.

Adtrack helps brands disentangle which parts of the marketing plan is working optimally, and is able to pinpoint whether the ad is cutting through from both a creative as well as a media perspective, and where you need to optimise your focus. In–market creative diagnostics, including brand linkage, enjoyment, message takeout as well as purchase intent/consideration are studied to help brands understand which elements of the campaign are delivering on target and which areas would need to be optimised. From our norms database we know that an average South African TV ad requires 300 – 400 AR’s in the first three weeks of launch to cut through at average levels (although this figure does vary greatly depending on the target market and category).

It is difficult to believe that any brand, creative or media planner would be proud to have an average campaign, yet the reality is that one in three campaigns recorded in 2019 are only average. Whilst averages do provide impressive context, unless brands make a concerted effort to track their campaign against these averages, averages on their own are meaningless. From a media investment point of view, Adtrack can help clients understand how to properly establish a campaign up–front so that the media investment required to maintain the ad can be optimally scheduled, ensuring that every rand spent is optimised during the campaign.

There is no doubt that categories and brands need to cut through the clutter and work hard to get the consumers’ attention, and there is certainly a plethora of clutter to work through in the South African advertising TV space! With so much competition, understanding how a campaign cuts through, and more importantly how campaigns can be optimised, delivers a real competitive advantage in this cluttered environment.

But grabbing attention in itself is not enough. Quite often you hear people rave about an ad, but when asked who the ad was for, they are not too sure! And what’s the point of great creative if you cannot link the ad to the brand? Both your media and your creative need to work in synergy to maximise your marketing budget.

Adtrack measures all Brand TVCs once, two weeks post the launch date. These measures are referred to as the newcomer weeks. The measure provides broad insights of how the TVC is essentially cutting through in-market based on how well it can be noted against the media pressure placed behind the advert.

Our sample is recruited from the major metropolitan areas based on strict demographic quotas that ensure a nationally representative TV viewing population. Our developed market is made up of predominantly LSM 7-10 respondents and the emerging market is predominantly LSM 5-6. The interviews are CAPI (Computer Assisted Personal Interviews) face-to-face interviews.

The newcomer measure for each advert includes the following:

Adtrack has three solutions that can help you understand whether or not your commercial is cutting through the clutter. Each solution offers more in-depth analysis than the previous.

Adtrack measures all brand TVCs once, two weeks post the launch date. These measures are referred to as the newcomer week. This measure provides broad insights of how the TVC is essentially cutting through in market. This measure is available for all brand ads in a category compared to relevant category (and country) norms. Available in a monthly report and soon to be available in an online dashboard. Access information for all TV advertising anytime, anywhere. If you want to know whether an ad is cutting through or not then this solution is for you.

Sample n=200 per advert, national representative sample. Timeline monthly

This solution provides slightly deeper insights as to how the TV advert is performing in market and it can also unpack as to why your advert is/isn’t cutting through. Three in market measures of prompted awareness and verified noting are asked over the launch burst or over the maintenance burst together with some key creative diagnostic questions that are scheduled once during the tracking period. With this solution we are able to compare your results against the category benchmarks as well as one key competitor.

Sample n=600 per advert, national representative sample. Timeline ongoing

Do you wish to know how to optimize future TV planning and ensure in-market cut-through is strong and maintained? Do you want to have the ability to simulate future ARS and work on maximizing budgets/creating savings? Then a full Adtrack solution is what you need. This is an in–depth look at the in-market performance of the commissioned ad from a media as well as a creative point of view. The focus is on the main commissioned ad but also includes competitive detail of 2 key competitors.

Sample n=1200 per advert, national representative sample. Timeline ongoing

Link to media pressure. All diagnostics are linked to TV media weights, thus we are able to understand the in-market impact relative to the media investment. We also use actual achieved TV ARS (so as to neutralize the effect of the cost of advertising in different timeslots/ programs), which is a more holistic approach than media spend.

Use both spontaneous and prompted questions. Adtrack uses spontaneous questions, ensuring that implicit associations are covered. Furthermore, every single ad is shown in full to respondents, ensuring that prompted questions are relevant to the advert. All metrics have been validated through multiple systems, both globally and locally.

South African norms. We have tested over 100,000 TV adverts in South Africa which means we can accurately benchmark all results to provide the correct insight against the correct norms.

Unlike other offers in the market, Adtrack looks at both a broad target audience (to see how well your advert will cut through across all ads) as well as how well your advert will cut through in your category. This is important as your ad needs to compete with all ads for consumer attention.

Have peace of mind knowing that the team working on your account has years of media research experience. They are thought leaders in media research and their expertise allows for better and more insightful business recommendations.

Monique Claassen, Head of Media & Digital, Kantar South Africa

e.

t. 010 036 0600