Top stories

More news

Marketing & Media

Capitec’s new jingle makes banking fees as easy as 1, 2, 3, 6, 10

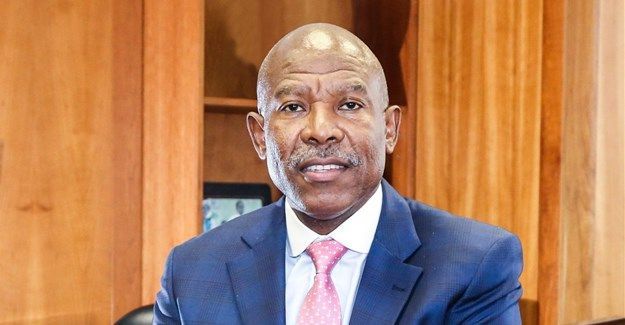

South African Reserve Bank governor, Lesetja Kganyago said this comes on the back of rising inflation caused by the outbreak of war in February between Russia and Ukraine; the global Covid-19 pandemic, higher oil-, commodity- and food prices and rising debt costs.

Three members of the Committee preferred the announced increase and two members preferred a 50 basis point rise in the repo rate.

The implied policy rate path of the Quarterly Projection Model (QPM), given the inflation forecast, indicates gradual normalisation through to 2024.

"As usual, the repo rate projection from the QPM remains a broad policy guide, changing from meeting to meeting in response to new data and risks. Economic and financial conditions are expected to remain more volatile for the foreseeable future. In this uncertain environment, policy decisions will continue to be data dependent and sensitive to the balance of risks to the outlook," Kganyago said.

The MPC will seek to look through temporary price shocks and focus on potential second-round effects and the risks of de-anchoring inflation expectations.

"Current repurchase rate levels reflect an accommodative policy stance through the forecast period, keeping financial conditions supportive of credit demand as the economy continues to recover," said Kganyago.

The Bank has ensured adequate liquidity in domestic markets and will continue to closely monitor funding markets for stress.

The statement of the Monetary Policy Committee forecasts:

The next statement of the Monetary Policy Committee will be released on 19 May 2022.

Read the full statement of The Monetary Policy Committee issued by South African Reserve Bank governor, Lesetja Kganyago here