The tough economic climate during 2017 induced pressure on the property market which did ultimately deter growth within this market. After renewed hope for this sector in 2018, unfortunately transactional activity remains subdued and as a result, business confidence has also decreased, recording the lowest number of transfers in the last three years for the third quarter of 2018.

The continued debate over land expropriation without compensation could also have a negative effect on all sectors of the property market, as talks of claims on commercial and retail properties have emerged.

Commercial property

In an analysis of the South African commercial property market, the largest number of transactions are made in the R 2.5m rand or less range. An evident spike in volume of transactions can be seen in the latter part of 2017 leading in to the first quarter of 2018.

The overall view of transactions between 2014 – 2018

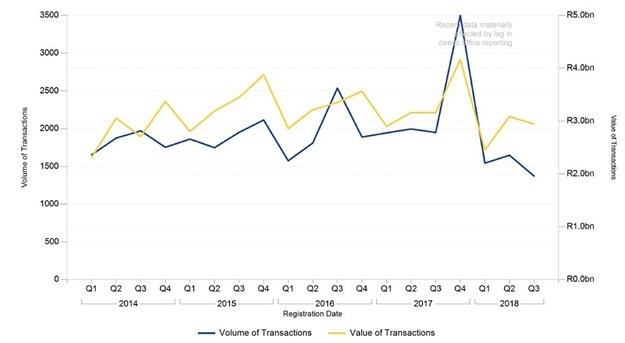

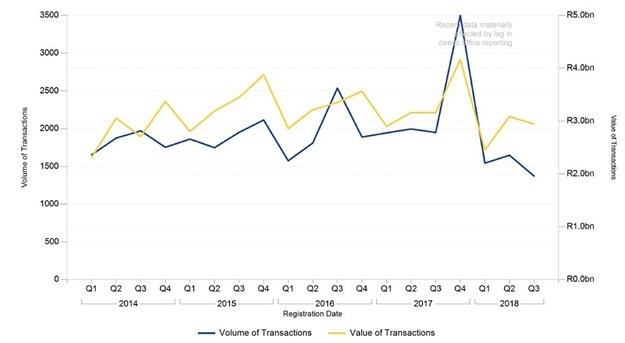

In a rather alarming finding, the total transfer values have dropped to around R3bn rand year-to-date, which is a loss of more than R1bn when compared to the same period in 2017. This is the most significant drop since 2016. Gauteng is still the zone experiencing the most transactions, followed by the Western Cape.

Volume and value of commercial property transactions between 2014 and 2018

Retail, industrial and office

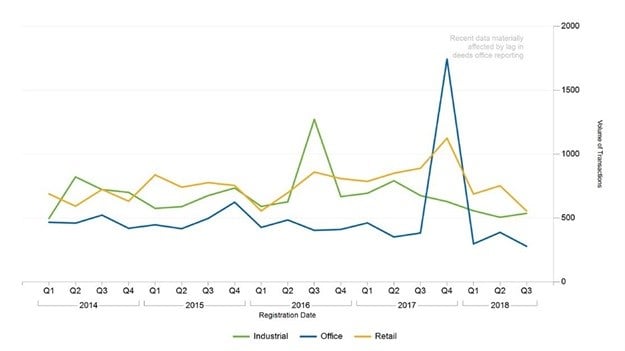

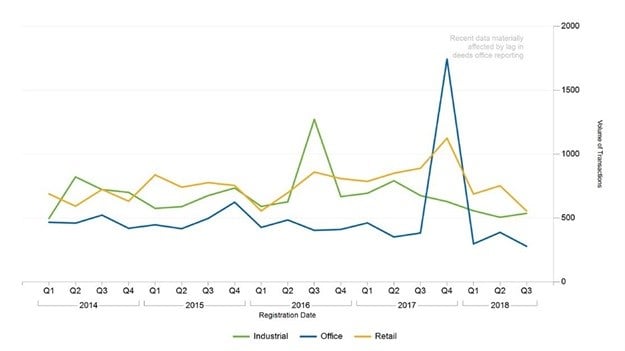

In an interesting finding during the third quarter of 2018, retail property had experienced the most registrations between these three sectors, with 525 transfers. This is closely followed by industrial property with 510 transfers and lastly office property with 250 transfers. Although growth within the retail space has slowed down there is still progress which is catalysed by consumer spending habits.

Volume of transactions during the period 2014 - 2018

The annual nominal inflation for the industrial, office and retail markets, indicate that industrial property is above the 6% mark, while the retail and office spaces are both at 5% and 4% respectively.

Inflation percentages for the industrial, office and retail market

In a summary of predictions for 2019, the following has been highlighted in Lighststone’s findings:

Industrial property has shown demand, and this can be mostly attributed to the development of the logistics sector in the country. It is forecast that the growth will steadily continue into 2019 as new projects and expansions are planned for the logistics sector.

In terms of property investments, the country will experience a similar trend in 2019 to what was seen in 2018. Subdued activity will ensue where companies will opt out of real estate investments until the 2019 general elections has been concluded. Dependent on the election outcome a slight uptick in activity can be expected.