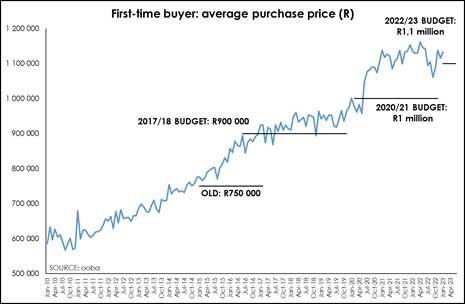

The announcement by the minister of finance during the 2023 Budget Speech that the brackets of the transfer duty table will be increased by 10%, allowing properties below R1.1m to avoid any transfer duty payments, is welcome news for aspirant home buyers.

This will in some measure help make home ownership more accessible for first-time buyers, particularly as the average price paid by first-time home buyers, according to Ooba, currently stands at R1.13m (January 2023). Also according to Ooba, applications from first-time home buyers rebounded to 47.7% in January 2023, following a low of 45.8% (December 2022), which was the lowest reading since early 2017 as the cumulative impact of repeated interest rate hikes weighed on household finances.

The introduction of tax measures to encourage businesses and individuals to invest in renewable energy and increase electricity generation is also welcome, although it is of concern that the overall cost to individuals for installing rooftop solar panels is beyond the reach of the majority of South Africans, plus the fact that this incentive is only available for one year and only 25% of the investment, up to a maximum of R15,000.

Tax relief needed for financially over-burdened consumers

Dr Andrew Golding, CE of the Pam Golding Property group. Source: Supplied

Furthermore, we would have liked to have seen tax relief measures further extended to individuals having to invest in a range of additional costs. These include gas stoves, generators, invertors, UPS devices, surge protection devices, battery-powered LED lighting, the costs of purchasing and running generators, batteries – including those utilised for security purposes, and the like. Surely such items, which carve a chunk out of household disposable income and which have become a necessity - amid the National State of Disaster declared for the energy crisis - should be considered for tax relief for financially over-burdened consumers.

As far as those home purchasers with the means to do so are concerned, and considering the current electricity crisis, we are finding that solar energy and inverters are increasingly in demand when looking to invest in a residential property. While difficult to quantify, the actual value-add in monetary terms, such features do make homes more sellable, as the property appeals to a wider market and will sell quicker than a home without these features.

Adjusting the personal income tax brackets for inflation is a positive, while it is a relief that there is no increase in the general fuel levy or Road Accident Fund levy, as fuel costs are already contributing to rising inflation and placing economic stress on consumers – in particular those in the lower income group whose daily transport costs eat away at their limited disposable income.

More than anything, we are hoping that government’s undertaking to act decisively to bring additional capacity onto the grid will materialise in the near future, as this is singularly the key factor hamstringing the country’s economic recovery.