In a deal that will make it one of the 10 largest department store operators in the world‚ Cape Town-based Woolworths (WHL) is set to buy Australian department store chain David Jones for R21.4bn (A$2.1bn).

The deal trumps US giant Walmart's R16.5bn buyout of Massmart as South Africa's largest retail sector transaction. It will see Woolworths stock South African products at David Jones as it seeks to turn around the Australian firm‚ which has underperformed over the past few years.

While shares in David Jones surged more than 22% A$3.92 on the Australian Stock Exchange‚ Woolworths slipped more than 8% to close at R67.90 as the market deemed the takeover to be on the expensive side.

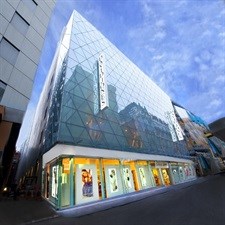

Also known as "DJ's"‚ David Jones is one of Australia's most prominent department stores. It operates 38 stores‚ which sell items such as gourmet food and wine‚ clothing and high-end beauty products.

Taking SA to Oz

Woolworths CEO Ian Moir said the deal "took South Africa to Australia".

"All the products that we have from South Africa and the SADC (Southern African Development Community) countries‚ which is around 40% of our total offer‚ will flow into David Jones‚" he said.

"Woolworths will have increased scale that will drive significant efficiencies and economies through enhanced global sourcing and the ability to leverage shared seasonality and trends‚ improving value for the customer and overall profitability."

The combination is aimed at creating a southern hemisphere juggernaut that will equip both retailers to compete with fast-fashion icons such as Zara‚ Topshop and H&M.

Woolworths‚ whose profits have grown 20% annually over the past five years‚ has increased its focus on apparel‚ investing in new systems and a merchant academy to train its buyers and designers‚ which has cut lead times as it has concentrated on quick-response fashion.

Steering David Jones into a new age

Stephen Kulmar‚ a retail consultant at New South Wales-based Retail Oasis‚ said the offer would bring a wealth of retail experience to "legacy business" David Jones.

"With heritage comes a lot of old ways of doing things and the deal should help (David Jones boss) Paul Zahra steer the ship into a new age‚" he said.

Amid competition from global players‚ David Jones has seen profit decline over the past three years as economic woes strain spending and the department store concept loses its allure.

Tough markert

PSG Konsult stockbroker Martin Strauss said many South African companies had gone to Australia and not succeeded.

"It's a tough market. I think the market feels that Woolworths is paying too much for the company. You normally see in a deal this big that the acquirer's share price will drop and the target's will increase‚ because a premium is paid for it based on the synergies that are expected to come‚" he said.

Woolworths has offered A$4 a share for David Jones‚ Australia's second-largest department store. That represents a 25.4% premium to its closing price on Tuesday.

Wary investors

According to 36One Asset Management equity analyst Daniel Isaacs‚ while Woolworth s' management had a good track record in Australia‚ investors were wary about the size of the deal.

"On the one hand they have done very good things with the Australia businesses but there are a few concerns ... it's not an easy apparel market ... it's very competitive and they are paying full price for this asset‚" he said.

"They aren't leaving much room for mistakes; the targets are aggressive and need to be executed well."

Financing

The deal will be financed with debt‚ cash and money raised in a rights issue. The renounceable rights offer will be launched soon after the transaction closes. Woolworths has secured an equity bridge facility that will be repaid with the proceeds of the proposed rights offer. The funding required has been underwritten by Citi‚ JP Morgan and Standard Bank.

Woolworths has operated in Australia for more than 15 years through its subsidiary‚ Country Road Group‚ which operates the Country Road‚ Trenery‚ Witchery and Mimco brands.

The David Jones deal will result in the group's Australian revenue growing from 20% of the retailer's total revenue in the first half of this year to about 43%.

Synergies of at least R1.4bn a year in earnings before interest and tax are expected within five years‚ as Woolworths grows David Jones's private label from 3% to 20% and introduces an improved customer loyalty programme.

David Jones posted an annual profit of A$95.2m in the past financial year.

Building the south

"The department store isn't dead - mediocrity is dead. In short‚ we're buying this business to build a bigger southern hemisphere brand‚" Moir said.

The retail sector accounts for 17% of Australia's A$1.5-trillion annual gross domestic product.

A survey this week by the Melbourne Institute and Westpac Bank showed that Australian consumer confidence rose this month for the first time in five months as households became more optimistic about the near-term outlook for the economy and their own finances.

Retail Oasis's Kulmar said there was no doubt the Australian market viewed the offer as a good return on shareholder investment‚ given that David Jones shares had not traded at $4 since 2011‚ and it had struggled with tough trading‚ legacy operational issues and instability at board level.

The deal is subject to shareholder approval and is expected to be completed by mid-July.

![Today, Halo and Demographica announce a new specialist agency, Second Rodeo]], headed up by Mike Stopforth (left). Dean Oelschig, managing partner and founder of Halo (right) says they will work as a group but ultimately, each agency will be an individual specialist](https://biz-file.com/c/2505/772543-64x64.jpg?2)