According to additional industry research conducted in August by OneDayOnly.co.za, 47% of those surveyed claim that more of their spend is now online, as opposed to traditional brick and mortar retail outlets.

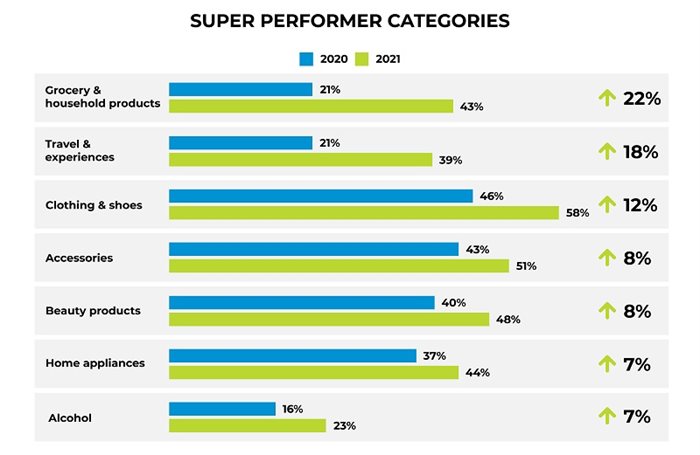

These shoppers have also diversified how they spend their money online – with an increase seen in 2021 from 2020 figures across all categories surveyed, including Travel and Experiences (up 18%), Groceries and Household (over double YOY, from 21% to 43%) and Clothing and Shoes (up 12%).

Forecasts indicate that 2021 will still see rapid e-commerce growth – purportedly reaching levels of R40bn.

However, for many of those surveyed, money has been tight so far this year. Despite forecasts indicating a continuation of record growth over the next year, consumers surveyed by OneDayOnly advise that they remain cash strapped.

With 46% reporting an overall decrease in household income, almost half the survey respondents also indicated that they had spent less money across all channels (online and in-store).

As a result, 73% of respondents were therefore looking for good affordable deals to get the best value for their money. Seventy percent indicated that they only shop for necessities, while 14% were on the lookout for bulk deals to further reduce costs.

OneDayOnly.co.za states that the data it gathers provides insights that allow it to adjust its product offering to cater to changing consumer needs, and that it highlights a shift in the way consumers spend their money.

In the short space of time that has passed between the last findings and these, accelerated e-commerce adoption is evident in the uptake of a wide range of product categories online (some doubling in volume shopped), and in the significant increase in online shoppers in the survey sample (from 79% in 2020 to 86% in 2021).

As consumer spending becomes smarter and competition between online retailers ever fiercer, OneDayOnly states that brands must apply focus to key categories; quality of offering being pivotal to this. Online retailers must also consider how their practices enrich the local economy and aid in combating a waning average household income to bolster continued industry-wide growth, the retailer says.