While more South Africans participated in the Black Friday shopping event in 2018 compared to the preceding year, the average spend per consumer dropped noticeably. The decline in per-customer spending was also visible in the United States (US), where the concept of Black Friday originated.

US online sales showed continued popularity with a 24% increase in transaction numbers, according to Adobe Analytics. Furthermore, this year’s Cyber Monday was the single largest shopping day in US history with reports of an estimated $7.9 billion spent - an increase of 19.7% from 2017.

Two in three South Africans participated in Black Friday in 2018; an increase from a 54% participation rate in 2017. From an online perspective, BankservAfrica counted over 400,000 sales transactions - a 55% increase compared to last year. Similarly, Cyber Monday sales transactions increased by this year to 176,595. In parallel, transactions per minute increased considerably on both days, according to Black Friday Global Analysis.

In contrast, electronic funds transfer (EFT) transaction values decreased by 19%. Retail management platform Vend reported that in-store retail spending in South Africa over the 2018 Black Friday shopping period decreased by 10% compared to last year, while volumes also saw a decrease of 2%.

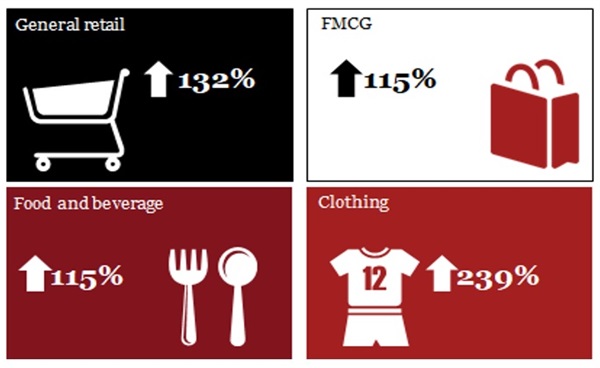

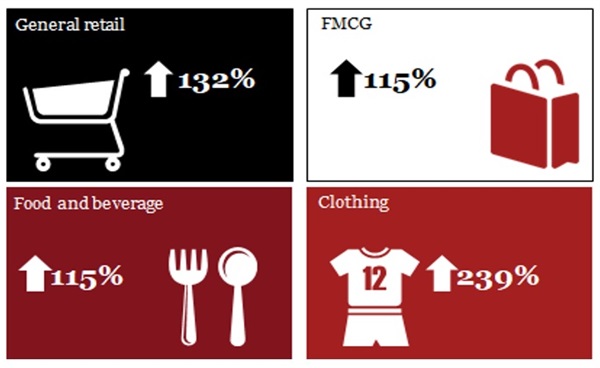

Nonetheless, spending results were encouraging in certain product segments. Clothes, electronics and shoes were the most bought items. Small business funder Retail Capital reported the following increases on credit card usage based on product category during the Black Friday weekend:

Winners during Black Friday weekend

Source: Retail Capital

Why did Black November sales disappoint?

Not only did South Africans spend less per person, the sentiment on social media around the sales event was sceptical. Results from a PwC survey posted on Twitter concurred with the results of a Twitter survey by News24. Both saw the majority of respondents expressing they would avoid the Black Friday shopping event.

Based on PwC analytics, trending words for Black Friday on 23 November included “ heavy discount”, “specials”, “deals” and “savings”, as retailers aimed to entice shopper. However, consumers’ feedback showed that sales were not in line with the traditional massive 50% to 85% price slashes seen in the US.

PwC analysis shows that, on Black Friday, 27% of related Twitter commentary in South Africa was negative. This was notably higher than just 6% seen a few days earlier. The negative feedback on social media reflected what consumers viewed as disappointing price discounts and underwhelming offerings.

Following disappointing sales discounts on Cyber Monday, some 53% of recorded social sentiment was negative on Tuesday, 27 November. In the days thereafter, negative sentiment was driven by customers reacting to mobile communication deals – especially cellular contracts – that did not come to fruition as expected.

Social media posts following Cyber Monday highlighted the frustrations experienced by consumers, with complaints about “order” delays and “delivery” challenges.

Excessive expectation build-up backfired

The local hype and build-up towards Black Friday was rampant. Being bombarded with several emails a day, seeing headlines on lampposts and talking about it with everyone around us - Black Friday seemed to be one of the hottest topics in November.

However, the build-up towards the day turned out to be larger than life. With discounts averaging 20% in stores and online, many consumers were left disappointed.

The framing and expectation build-up surrounding Black Friday were disproportional to the sales discounts actually on offer on the day. Consumers were primed by the promise of massive discounts: in the US, discounts of 80% are commonplace on the day. In reality, South Africans were left frustrated, holding off on further shopping after realising the promise of significant sales discounts was exaggerated.

Lullu Krugel, Christie Viljoen and Maura Feddersen 23 Nov 2018

Missing out on scarcity and urgency in sales promotions

Rather than only concentrating on Black Friday sales, many stores aimed to stimulate spending during the entire month of November – resulting in what is now known as Black November. Discounts were on offer during the entire month, thereby diminishing the once-off special and never-before-seen appeal of Black Friday. Consumers tend to react to the idea of scarcity and urgency: When an item is in short supply, we tend to view it as more valuable.

In this case, however, South African consumers were becoming familiar with the idea of seeing sales in stores; diminishing the rush and urgency of buying a specific product before the sale concludes. The familiarity associated with discounting in stores and online meant consumers would not buy a product unless its price dropped even further. Various online stores offer discounts throughout the year, meaning they would have had to run extreme price promotions before experiencing a larger spike in sales.

Priming in favour of responsible shopping

There were also several warnings from consumer groups, financial regulators and news publications in the lead-up to Black Friday to warn against excessive spending and overindulging. This may very well have primed consumers to spend less and more consciously, tempering excessive spending. With the lead-up to Christmas holidays and the expenses that go with it, the warnings likely hit home, making it top of mind that consumers should be more cautious when spending money, even in the face of widespread sales.

Implications of Black Friday performance for Christmas sales

StatsSA announced on 4 December that South Africa’s economy had exited the technical recession in the third quarter following a GDP growth increase of 2.2% quarter-on-quarter (q-o-q). Household final consumption expenditure also increased in the third quarter, rising by 1,6% q-o-q. The main contributors were food and non-alcoholic beverages, furnishings, household equipment and maintenance, clothing and alcoholic beverages and tobacco.

However, it remains to be seen whether the recovery in household spending is sustained and will boost Christmas shopping sales. Alternatively, will festive sales this year see the same mixed outcome as Black Friday? For now, retailers are faced with a South African consumer that remains under pressure. Unsurprisingly, business confidence amongst retailers remained in net negative territory during the fourth quarter of 2018, according to a survey by the Bureau for Economic Research (BER).

According to the FNB/BER Consumer Confidence Index (CCI) released on 28 November, overall consumer sentiment decreased by 15 points between the second and third quarter. Furthermore, the household financial outlook dropped from 31 in the second quarter to 13 in third quarter. In parallel, inflation increased in October to 5.1% year-on-year (y-o-y) from 4.9% y-o-y in September, adding further strain to consumers’ purchasing power. Consumers have felt the pinch from continued petrol price hikes during 2018 leading to a record high price of R17.08/litre in November.

Income levels and access to credit must be considered as primary influencers of sale participation. If Black Friday sales showed a decrease in popularity and spend, Christmas sales are likely to see a similar outcome unless stores (physical and online) display considerably higher price discounts.

Overall, the signals sent by disappointing Black Friday numbers and other related data suggest a mediocre outlook for Christmas retail sales.