Trending

Elections 2024

Jobs

- Journalist Intern Cape Town

- Show Producer Johannesburg

- Media Production Administrator Cape Town

- Scriptwriter Somerset East

- News Editor Johannesburg

- Mid-Level Sub-Editor Cape Town

- Music and Scheduling Lead Johannesburg

- Media Planner/Buyer Johannesburg

- Videography Intern Cape Town

- Online Managing Editor Johannesburg

Majority of SA companies fail to gain competitive advantage

This was the chief finding of the latest Supply Chain Intelligence Report (SCIR), compiled by TerraNova Research, which focused on the supply chain and logistics industry in South Africa.

What is SCIR 2009?

The SCIR is an annual, international and independent study into the supply chain and logistics practices of emerging economies around the world. Over 200 senior company officials from both a general management and supply chain perspective, as well as from a diverse range of industries, took part in the South African survey.

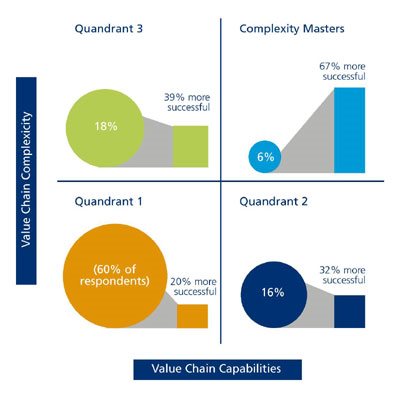

The study incorporated the Complexity Masters theorem, developed and published by Deloitte in 2003, which holds that companies in the USA and Europe with complex value chains, and importantly the capability to properly manage those complex value chains, are 73% more profitable than their peers. It was found that these highly successful Complexity Masters constituted only 7% of the total number of companies in their sample. When TerraNova Research applied the theorem to the South African context, 6% of the total number of companies surveyed were 67% more profitable than their peers. (See diagram)

Diagram: South African Complexity Masters

Using the quadrants developed by Deloitte, TerraNova Research analysed and compared the differences in the responses between the Complexity Masters with high complexity and high capability in quadrant four, and their direct counterparts - the companies represented in quadrant one with low complexity and low capability. They then compared the capabilities of these two quadrants with respect to visibility ratings (the ability so see changes in demand and supply), and reactivity (the ability to react in time to ensure high service levels and to minimise overstocking and obsolescence).

The focus areas of the study that were analysed included collaboration, technology - to gauge visibility, reactivity, the impact of local and global trends, and the sensitivity of business to changes in their marketplaces

Key findings

While collaboration is universally recognised as a key component in achieving competitive advantage and profitability, the levels and areas of collaboration with suppliers and customers between quadrants one and four was vastly different. Only 27.9% of the sample in quadrant one reported collaborating with their suppliers, with than twice that amount of Complexity Masters claimed to be collaborating with their suppliers (62.0%). Similarly, only 22.8% of quadrant 1 respondents asserted to be collaborating with their customers, compared to 60.2% of the Complexity Masters.

These results give a clear indication as to how the Complexity Masters enjoy greater visibility - their levels of collaboration both forwards and backwards along the supply chain are significantly greater than that of their peers in quadrant one.

Supply chain reactivity or flexibility is another fundamental attribute in order to successfully deal with change as and when it arises. This has become no truer than during the events of 2008 which saw spiking fuel prices, rising food and energy costs, and a global meltdown of financial institutions. The ability to be flexible and reactive as supply and demand changed, and continues to change, is vital not only to a company's ability to survive, but also, as conditions improve, to thrive.

The report gives startling insight into the level of reactivity the majority of South African companies can hope to achieve. Only 66.1% of quadrant 1 participants claim reactive capability to some degree. This stood in contrast to a very high percentage of the Complexity Masters who indicated their agreement with the statements (95.2%). The result clearly demonstrates their ability to deal with changing circumstances more effectively compared with their less reactive, and thereby less successful peers in quadrant one.

Intuition and sensitivity count

The South African SCIR 2009 not only revealed several strategies which the most complex and capable companies in South Africa have adopted to increase their visibility and reactivity, thereby minimising the planning and forecasting challenge. A further discovery was gained through the study - the importance of “market sensitivity,” i.e. the ability to read the signs of the changing market and make provision for their impact before the event horizon. This ability (albeit intuitive or just meticulous observation) is a definite characteristic of the Complexity Masters, giving them an edge over their competitors and contributing to a large part of their success and sustainability.

Key conclusions

For SCIR 2009 TerraNova Research hypothesised that competitive advantage from a value chain point of view emanates from a company's ability to operate both more efficiently and more effectively. Both of these measures are enabled by improved forecasting and planning, something the marketplace is under increasing pressure to achieve. The evidence gained through the research clearly shows a significantly better performance from complexity masters than from the rest of the sample.

The hypothesis further postulated that in high change environments, companies need to improve supply chain visibility, to allow them the maximum lead time to change plans to suit the changing environment. This visibility, TerraNova Research maintains, is enabled by the use of appropriate technology, and by collaboration both up and down the supply chain.

Once a business has some degree of visibility, the hypothesis continues, its success will depend on its relative ability to react with agility and flexibility. We believe that the essential components of reactivity are flexibility with respect to the ability to deploy supply chain assets, and their ability to assemble a virtual best of breed supply chain team that can redesign, implement and operate what will need to be almost an organic supply chain - one that changes and learns continuously.

Clearly organisations that have integrated systems, which can turn fixed costs to variable costs through in- or outsourcing, and that have strategic relationships with supply chain partners that give them a virtual best of breed team, are more able to react to the change that is so inevitable.

SCIR launch

If you would like to learn more about the collaboration strategies of South Africa's most successful companies and their approach to achieving competitive advantage, book your seat to attend the launch of SCIR 2009 at 3pm in Johannesburg on 9 March 2009, and Cape Town on 11 March.

The cost per delegate to attend the launch of SCIR 2009 is R250 (incl. VAT) and includes a free copy of the research report.