Trending

Elections 2024

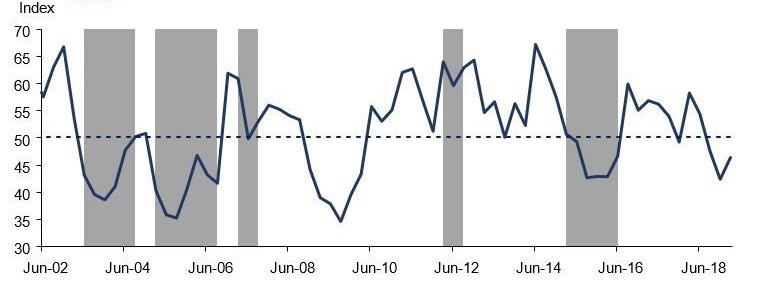

Agbiz/IDC Agribusiness Confidence Index improves marginally in Q1 2019

The survey was conducted between 28 February and 15 March and comprised agribusinesses operating in all agricultural subsectors across South Africa.

The overall Index comprises ten subindices, most of which are still generally subdued compared to the long-term average levels, which is since its inception in 2001. Be that as it may, the marginal uptick in the overall Index in the first quarter of this year was underpinned by seven out of the ten subindices.

Discussion of the subindices

After deteriorating to the lowest level since the first quarter of 2010, confidence regarding the turnover subindex improved by 13 points to 61 in the first quarter of 2019.

Agbiz/IDC Agribusiness Confidence Index

This optimism stems from agribusiness operating in the horticultural, livestock, agrochemicals and wine subsectors. In line with the turnover, confidence in the net operating income subindex increased by 9 points from the fourth quarter of 2018 to 46 in the first quarter of this year. In addition to the aforementioned factors, the uptick in agricultural crop futures has, to some extent, also boosted sentiment in this subindex.

The sentiment regarding the market share of the business improved from 60 to 64 points in the first quarter of the year. The observations across the respondents suggest that the optimism was also driven by the horticultural and livestock subsectors, as well as agrochemical entities.

Encouragingly, the capital investments confidence improved further by four points to 62 in the first quarter of this year.

This is partly mirrored in the agricultural machinery sales, specifically tractors and combine harvesters, which showed solid performance in February 2019. This was a continuation from 2018 robust sales where total tractor sales amounted to 6 680 units, up by 4% from 2017.

In terms of combine harvesters’ sales, about 200 units were sold, up by 2% from 2017. Nonetheless, a number of respondents continue to highlight the ongoing land reform policy discussion as a key issue that they are observing closely, and the outcome of which could influence investment decisions going forward.

Confidence regarding the export volumes subindex increased significantly by 19 to 56 index points in the first quarter of 2019.

This optimism stemmed from the horticultural and livestock subsectors. From a horticulture perspective, the Citrus Growers’ Association recently noted that exports could reach a record level of 137 million boxes of citrus fruit in 2019. Moreover, the South African Wine Industry Information and Systems noted the possibility of a relatively larger harvest of wine grapes this year, which should boost exports.

In terms of livestock, while the outbreak of foot-and-mouth disease earlier this year led to a number of countries placing a temporary ban on South African beef exports, the Department of Agriculture, Forestry and Fisheries is engaged in discussions to re-open markets for South African beef in the African continent, and also to the Middle East.

Although the sentiment is fairly positive from the horticulture subsector, the general agricultural conditions subindex fell by eight points to 32 in the first quarter of 2019.

This is due to below-average rainfall at the beginning of this year particularly in the central and western parts of South Africa. This subsequently delayed the planting activity in these respective areas and also resulted in reduced summer grains and oilseeds area plantings. South Africa’s 2018/19 summer grains and oilseeds plantings are estimated at 3.7 million hectares, down by 3% year-on-year.

The perception regarding economic conditions improved by three points to 21. With that said, this is still well below the long-term average. Moreover, the renewed power outages across the country, and disappointing high-frequency data over the past few months, suggest that South Africa's economic fortunes could remain constrained for the better part of this year.

Confidence regarding employment in the agricultural sector deteriorated marginally by a point from the last quarter of 2018 to 54. Although the horticultural sector will probably see increased activity on the back of an expected large harvest, the summer crop areas will most likely experience a decline in activity, and therefore employment.

The debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices.

A decline is viewed as a welcome development, while an uptick is not a desirable outcome as it shows that agribusiness is financially constrained. In the first quarter of this year, the sentiment regarding the debtor provision for bad debt declined by 10 points to 32, partly due to the expected better performance of the horticulture subsector. Meanwhile, the financing costs subindex increased by 8 points to 38.

The overall improvement in sentiment in the first quarter of 2019 is a welcome development, but it is by no means a cause for celebration, as confidence levels in the agricultural sector are still in the contraction territory, at levels below the neutral 50-point mark. The glimpses of optimism were mainly in horticulture, livestock and agrochemical related businesses, whereas other subsectors expressed despondency due to the expectation of a poor harvest on the back of erratic rainfall earlier this year. Above all, most respondents’ additional comments are still centred around the subject of land reform.

While investments in movable assets such as agricultural machinery have been encouraging over the past couple of months, the outcome of the ongoing land reform processes, such as the President’s Advisory Panel, and Parliamentary Review Committee, amongst others, are key to determining the path for fixed investments in South Africa’s agricultural sector, and thereafter long-run growth prospects and employment.