Growing geopolitical tensions in the Middle East have begun to disrupt global supply chains. Following attacks by Houthi rebels on vessels passing through the Red Sea en route to the Suez Canal and key global economies beyond, major shipping companies have warned of significant delays to deliveries.

Source: Supplied. David Rees, senior emerging markets economist at Schroders.

Satellite images show that virtually no ships destined for major European ports or the US and UK are currently passing through the Red Sea. Instead they are diverting around southern Africa.

The latest disruption follows problems at the Panama canal, where a combination of drought associated with climate change and shifts in rainfall due to El Nino, have caused water levels to fall. Meanwhile in Europe wet weather means that the level of the Rhine, a key shipping route for German manufacturers, is too high.

And with the upcoming elections in Taiwan presenting a risk of a repeat of Chinese military drills that disrupted Asian shipping routes in 2022, it seems that global supply chains face a perfect storm of risks.

All of this evokes painful memories of the supply-chain problems that erupted during the Covid-19 pandemic. These contributed to the recent bout of high inflation that ultimately forced global central banks to aggressively raise interest rates. Markets are now pricing in aggressive interest-rate cuts in Europe, the UK and US, with some cuts anticipated as early as the first half of 2024.

All of this begs the question of whether renewed supply-chain problems are about to drive up inflation, forcing policymakers to reassess their outlooks.

Source: Supplied. LSEG. - 4 January 2024. Ships destined for major global economies are diverting away from the Red Sea. (Green – bulkers, Orange/yellow – tankers, Blue – containers, Pink – other vessels.

Much will depend on how long the current disruptions last, but at least three important differences in the global economic backdrop suggest that problems in the Red Sea are unlikely to lead to major increase in inflation.

First, demand conditions are now much softer. Whereas large monetary and fiscal stimulus fired up the global economy following the initial disruption caused by the global pandemic, growth is now slowing. We project global GDP growth of just 2.5% both this year and next. The eurozone is probably already in recession, the UK is weak and activity in the US is cooling.

Second, whereas lockdowns to contain the spread of Covid-19 meant that demand was concentrated into the goods sector during the pandemic, consumption patterns are now much more balanced. Indeed, the reopening of economies caused demand to skew back towards services over the past couple of years, leaving the global manufacturing sector in recession.

Third, the supply side of the global economy is also in much better shape. Whereas rolling lockdowns completely closed production during the pandemic, there are no such disruptions now.

Detours around southern Africa will lengthen delivery times, but goods will still arrive at their destinations – suggesting that outright shortages are unlikely. If anything, recent trade data from China showing exports growing far more quickly in volume than in value-terms, suggest that firms in at least some sectors are having to discount prices to clear excess capacity.

Source: Supplied. LSEG. Demand for goods is soft, while there is plenty of supply.

Risks to commodity supplies

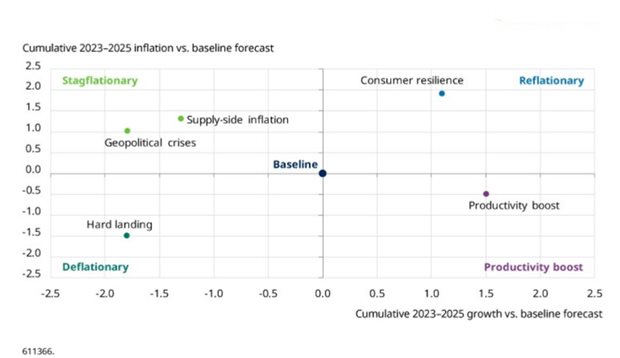

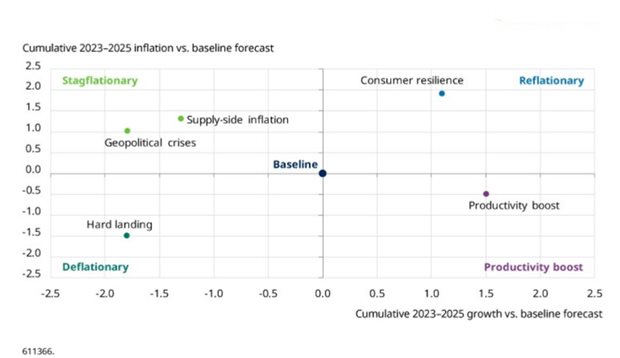

A more immediate risk to global inflation would be if tensions in the Middle East begin to affect the supply of commodities, in particular driving up energy prices. This is something that we began tracking in our latest forecast round with our Geopolitical Crises that assumes, in addition to trade frictions, a broadening of tension in the region causes oil prices to climb towards $120 per barrel.

Our simulation moved the global economy in a stagflationary direction as higher energy costs drive up inflation, with the risk of secondary effects (given tight labour markets) weighing on growth and forcing central banks to abandon rate cuts and perhaps even hike further.

So far, though, oil prices have been well-behaved with Brent crude largely unchanged at just under $80 per barrel.

Source: Supplied. A spike in oil prices would push the global economy in a stagflationary direction.

At the very least, though, the latest hiccup in shipping routes serves as yet another reminder of the risks that stem from relying on lengthy supply chains in a more fractious world. As a result, the rewiring of global supply chains that forms a key pillar of the 3D reset looks set to continue.