Subscribe & Follow

Jobs

- Business Development Specialist Johannesburg North

- Business Development Consultant - Commercial Western Cape

What can SMEs expect in 2021?

E-commerce and technology adoption

If there is one single change a business owner should focus on to bring about success following Covid-19, it’s increased digitization of the business.

“It goes without saying that increasing and improving your digital footprint and capabilities is now more important than ever. The level of digitalisation required is dependent on industry and where the bulk of your customers are, but having said that, even in the more industrialised spaces you can’t get away from creating your digital identity.” says Trevor Gosling, CEO and co-founder of Lulalend.

“During South Africa’s national lockdown, for example, e-commerce grew by a staggering 40%. In our business we saw similar patterns with an increase of 20% in loans made to online retailers,” says Gosling

If the new digital capabilities you’ve integrated into your operating model during 2020 have been successful, remember, now is not the time to stop. While e-commerce is not relevant for all sectors, having an online presence is now vital to increase awareness for any business.

If you’re likely to be looking for additional funding, it's worth remembering that a key metric lenders look for is ‘’resilience of sales and income streams’’. "A broader range of sales or lead acquisition channels will make you more likely to attract funding, and also at more competitive rates. Keep future proofing your business." adds Neil Welman, co-founder of Lulalend.

A huge amount of investment is also going into developing tech focussed services to help run a small business. Never before has the range or depth of online SME services been greater, from payments and cash flow management platforms to services that manage the everyday jobs-to-be-done in any small business. A lot of them are free to use until your business scales substantially, so don’t be afraid to try them out. There’s never been a better time than now in terms of having easy access to digital tools to help you run your small business, allowing you to focus more on what you do best.”

Sectors that will thrive in 2021

The general theme for 2021 will be less about turning heads and more about trying to get back to pre-Covid levels. There are certain industries like e-commerce that will continue to grow and do well, but most other industries in the small business sector are reliant on improved macroeconomic factors to drive performance.

For some industries, the only way is up. The hospitality industry for example should hopefully see a dramatic increase in activity once vaccines are distributed and pent-up demand from international travellers filters through.

Government will also look at ways to stimulate the economy and use increased infrastructure spending to generate activity and present smaller construction companies with improved project pipelines.

The low interest rate environment will continue to assist retail spend and as things start to normalise there will be the opportunity for improved discretionary spend in non-essential products and services.”

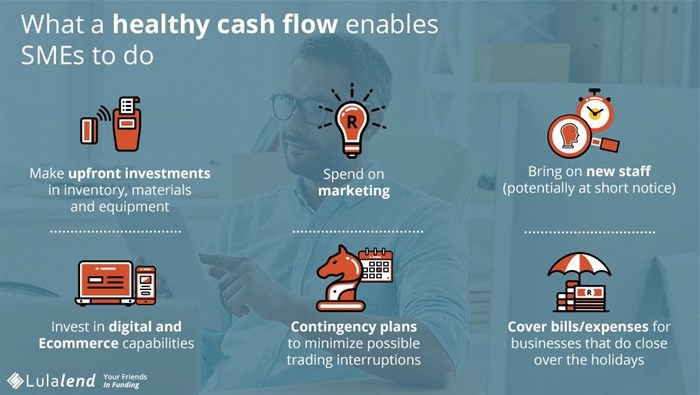

Cash flow management is critical to not just survive, but thrive

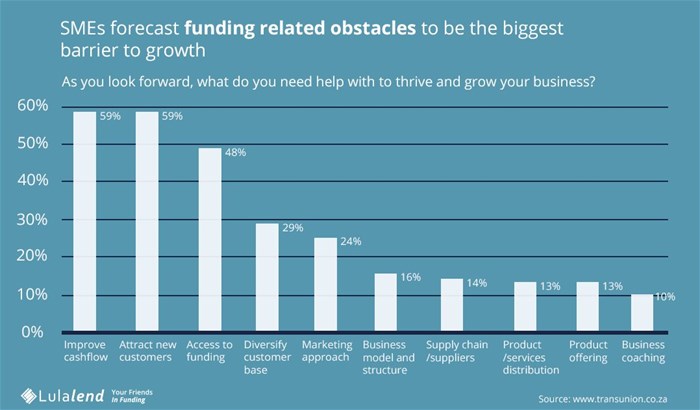

Arguably the most important lesson for businesses to take away from 2020 is the need to build up cash flow reserves. According to TransUnion, almost 50% of businesses state that improved access to funding is the area they most need support with to both survive and grow.

Not only do deeper cash reserves provide a buffer for unexpected events, it also provides the opportunity to take advantage of deals that would otherwise pass by. Small business owners may consider cash in the bank as lazy capital, but there is incredible value in having cash resources available when situations get sticky or significant opportunities present themselves. "Aim to build cash reserves of four to six months’ worth of your average monthly expenditure to give you this freedom." says Gosling.

How to get the right funding

While many small to medium sized businesses struggle to get loans from traditional lenders, it’s important to know there are a range of non-traditional fintech lenders that can also help businesses access funding.

The benefits fintechs offer SMEs include:

- Fast and straightforward application process

- No paperwork or red tape

- Do not require collateral as security against finance

- Approval decision made instantly and funding received within 24 hours

- Flexible and transparent repayment terms, often with no early repayment fees

- No restrictions on the use of funds