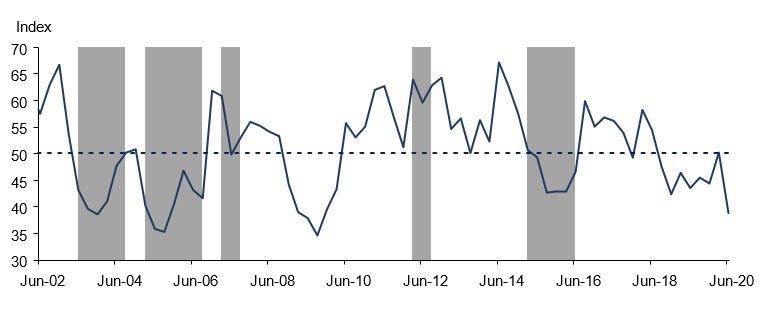

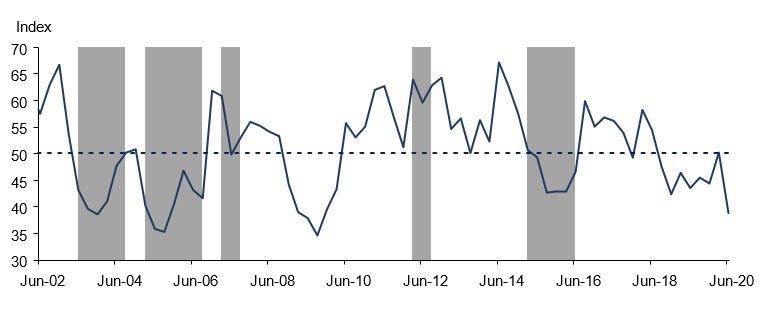

The Agbiz/IDC Agribusiness Confidence Index (ACI) fell from the 50-point mark in the first quarter of the year to 39 in the second quarter. This is the lowest level since the third quarter of 2009, at the height of the global financial crisis.

A level below the neutral 50-point mark implies that agribusinesses are downbeat about prevailing business conditions in South Africa.

The ongoing Covid-19 crisis is primarily a health shock, but its impact on the economy has been severe and these sentiment results are a reflection of that. This second-quarter survey was conducted between the final week of May and the first week of June 2020. The ACI covers agribusinesses operating in all agricultural subsectors across South Africa.

Figure 1: Agbiz/IDC Agribusiness Confidence Index

Source: Agbiz Research, South African Weather Service(Shaded areas indicate periods when rainfall across South Africa was below the average level of 500 millimetres)

The ACI comprises 10 subindices and all showed a significant decline in the second quarter of the year, with most reaching their lowest levels since 2009. This comes despite the fact that

South Africa's agriculture and the food sector in particular, was operational during the strict level-5 lockdown period, except the wine, floriculture, wool and cotton subsectors, amongst others, which only resumed operating fully from level 4 and 3.

Discussion of the subindices

• Confidence regarding the turnover fell by 35 points from the first quarter of the year to 29 in the second quarter. This is the lowest level since the third quarter of 2009. This pessimistic view was held across agribusinesses operating in various subsectors, except the financial service firms. In the case of summer grains related businesses, lower income from storage and handling was, in part, a key factor underpinning the decline in confidence. The challenges about grain quality lowered the amount of tradeable grain in the market, especially for old-season white maize.

Moreover, the late grain deliveries for the new season, which started later than normal because of delayed summer rains, also weighed on the sentiment. In the agricultural machinery businesses, the downbeat sentiment in the turnover subindex is somewhat in line with continuous poor sales in the first couple of months of this year. In the livestock sector, the ban of auctions and the closure of the restaurants when the lockdown started, which accounts for a notable share of meat consumption, continue to weigh on the incomes of firms and farms.

Broadly, the decline in retails sales of various agribusinesses as a result of lockdown regulations also weighed on sentiment.

• In line with the turnover, confidence in the net operating income subindex fell by 40 points from the first quarter of the year to 21 in the second quarter. This too is the lowest level since the third quarter of 2009. The factors underpinning this decline are similar to the aforementioned ones of the turnover subindex.

• The market share of agribusinesses subindex was at 63 points in the second quarter of 2020 from 67 in the first quarter. Most agribusinesses maintained a generally unchanged view in this specific subindex compared to the previous quarter, with those in agricultural insurance and financial services showing an uptick.

• The employment subindex was at 36 points in the second quarter of 2020 from 47 in the previous quarter. While this is the lowest level since the third quarter of 2009 for this particular subindex, it is not at its lowest levels as other subindices. This is perhaps an indication that agricultural employment might not take a huge knock as the sector.

has remained operational and is expecting bumper harvests in the case of summer grains and within horticulture, specifically citrus. A decline in employment in the sector has probably been within the seasonal labour as various firms aim to adhere to health regulations which involve social distancing. The real effect on employment, nonetheless, will be clear when Stats SA releases the Quarterly Labour Survey data.

• The capital investments confidence subindex fell by 6 points from the first quarter of 2020 to 38 in the second quarter. The downbeat sentiment in this specific subindex is in part due to general challenging financial conditions amid the Covid-19 pandemic.

Another aspect that agribusinesses remain unclear about is whether there will be a change in policy direction post-Covid-19, and what will be the view on land reform in such a new world. Land reform will remain of interest after the current crisis and its outcome will be an important determinant of the direction that South Africa’s agricultural sector will be taking.

• The subindex measuring the volume of exports fell by 8 points from the first quarter of 2020 to 36 in the second quarter. The subdued sentiment in this particular index could be a temporary blip, e.g. disruptions in port functionality, as we anticipate increased exports through the year due to expected large summer grains and oilseeds harvests, and also horticulture production.

While the pandemic has disrupted global supply chains, the global agricultural and food trade has thus far not been severely hampered and conditions could improve as more countries are starting to reopen their economies and allowing the movement of people and goods/commodities.

• The perception regarding general economic conditions in the country deteriorated by 18 points to 10 in the second quarter of this year. This is unsurprising as the Covid-19 pandemic and lockdown measures implemented to slow its spread have disrupted business activity across different sectors in South Africa and across the globe. The South African Reserve Bank currently forecasts a 7% contraction for the South African economy in 2020.

• Confidence regarding general agricultural conditions fell by 25 points from the first quarter to 53, which is above the neutral 50-points mark. This shows that while the pandemic has had a broad economic impact, the agricultural sector has not been as hard hit as other sectors of the economy for two major reasons. First, the sector has been classified as an essential service and allowed to operate, albeit some subsectors were prohibited.

Second, the pandemic arrived when summer crops were already in season and caused minimal disruption on production conditions. This is also in a year where South Africa is set to harvest its second-largest summer grains harvest on record and also a record citrus harvest, due to favourable weather conditions.

• The debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a favourable development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the second quarter of 2020, the sentiment regarding both subindices, debtor provision for bad debt and the financing costs, increased by 3 and 40 points from the first quarter to 26 and 75, respectively, and went into an unfavourable direction.

These results were surprising given that the South African Reserve Bank had recently cut interest rates agressively. This suggests that lenders may have become more risk-averse due to COVID-19-related uncertainty.

While South Africa’s agricultural sector could register an improvement in output in 2020 compared to the previous year, and also an increase in export earnings, the cloud of uncertainty around the pandemic could continue keeping the sentiment depressed.

With several economies set for sharp contractions because of the pandemic, the challenge South Africa’s agricultural sector will likely face is a potential decline in demand locally and from several traditional export markets, and thus by extension lower agricultural commodity prices. This, in turn, will weigh on farmers and agribusinesses’ finances and possibly the sentiment.

Another important focus in the coming quarters will be on domestic agricultural policy, specifically land reform, which had dominated the landscape before the pandemic. Any path government takes in this particular policy will have an impact on levels of investment into the sector, and thereafter long-run growth prospects.