In week 10 of the Barclays Accelerator Programme, we interview Rob Guilfoyle, founder of Abe AI which designs artificial intelligence (AI) solutions for the banking industry. The startup helps banks to better engage and support their customers at scale, and to significantly reduce the costs of servicing and acquiring customers through the use of chatbots.

Tell us about your startup business. How did you come about the idea?

Keith and I met while working at a financial education company. We were helping people better understand their finances, but both of us felt like that wasn’t enough. We wanted to take things one step further and give people the tools they need to actually achieve their financial goals.

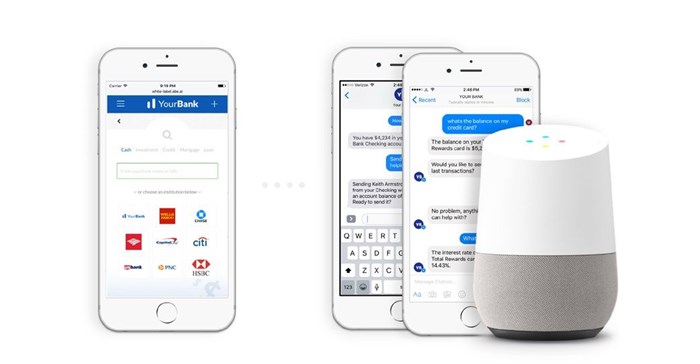

We decided the best way to do that is to put artificial intelligence to work for everyone. So we built a platform that gives banks and their customers real-time data insights that make finance simpler and easier. We combine smart financial forecasting with the convenience of chat apps to weave banking into everyday life.

Our goal is to help banks make a real difference in their customers’ financial lives. We see this as a win-win, and we’re excited to be a part of it.

How did you hear about, and what motivated you to apply for, the Barclays Accelerator programme?

Keith was one of the first employees at a company called Startup Weekend, a programme that helped launch startups around the world. That company was eventually acquired by Techstars, so we were already familiar with the benefits of the global tech network. After we founded Abe AI, one of the first things we did was apply to Techstars. This year, the timing was perfect for us, and we were thrilled to be selected for the programme.

What is the long-term vision for your company?

We want to help everyone live their best financial life. For us, that means partnering with banks to give their customers the best possible financial advice, products, and services. Our long-term vision is to work with banks of all sizes around the world to make this mission a reality.

What do you hope to gain/learn from this programme?

The biggest thing we’re hoping to take away from this programme is a deeper understanding of what we can do for global banks like Barclays. Working so closely with the Barclays team is an incredible opportunity for us to solve real banking problems right now and bring our solution to the African market.

What are you most looking forward to in the upcoming 13 weeks of the programme?

Demo Day. We’re learning so much from the Techstars mentors and associates and growing so much as a team. We’re really looking forward to sharing our accomplishments with the Techstars community and seeing how far the other teams have come, too.

What are you most unsure of/nervous about?

One type of artificial intelligence we’re using (machine learning) requires a lot of data to be able to accurately detect patterns and predict future events. One of our biggest challenges is to gain access to the data we need to be able to build the best possible version of our product.

How do you define the word "success"?

How do you define the word "success"?

I think most people would define “success” as making a positive impact on the world. For us, that means making finance simpler and easier so that people can focus on the things that really matter to them. And that goal is at the heart of everything we do.

Tell us about your startup business. How did you come about the idea?

Tell us about your startup business. How did you come about the idea?