Subscribe & Follow

#AfricaMonth

In the news

Sarb hikes repo rate by 25 basis points

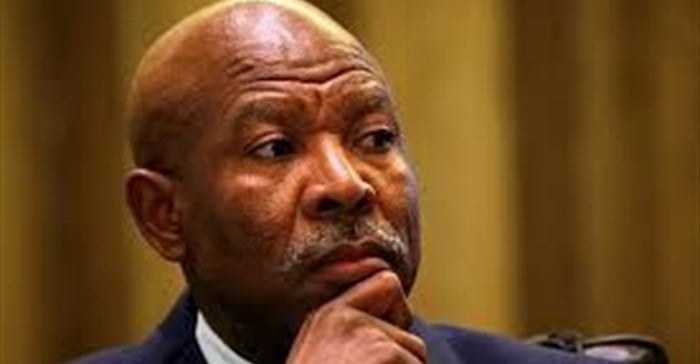

Governor Lesetja Kganyago said a multi-year electricity price increases, which made it difficult to disentangle first- and second-round effects.

“The approach of the MPC is to look through the first-round effects and focus on the possible second-round effects of supply side shocks. However, the MPC had to decide whether to act now or later. Given the relative stability in the underlying core inflation measure, delaying the adjustment could give the MPC room to re-assess these unfolding developments in subsequent meetings,” he said.

Delaying the adjustment could cause inflation expectations to become entrenched at higher levels and thus contribute to second-round effects, which would require an even stronger monetary policy response in the future.

“Against this backdrop, the MPC has decided to increase the repurchase rate by 25 basis points to 6.75% per year, effective from 23 November 2018. Three members preferred an increase and three members preferred an unchanged stance,” Kganyago said.

The committee, he added, continues to assess the stance of monetary policy to be accommodative.

Anchoring inflation

Monetary policy actions will continue to focus on anchoring inflation expectations near the mid-point of the inflation target range in the interest of balanced and sustainable growth.

“As previously indicated, any future policy adjustments will be data dependent. The implied path of policy rates generated by the Quarterly Projection Model is for four rate hikes of 25 basis points, reaching 7.5% by the end of 2020.

“The forecasted endogenous interest rate path is built into our growth and inflation outlook. As emphasised previously, the implied path remains a broad policy guide, which can and does change in either direction between meetings in response to new developments and changing risks,” said Kganyago.

Source: SAnews.gov.za

SAnews.gov.za is a South African government news service, published by the Government Communication and Information System (GCIS). SAnews.gov.za (formerly BuaNews) was established to provide quick and easy access to articles and feature stories aimed at keeping the public informed about the implementation of government mandates.

Go to: http://www.sanews.gov.zaRelated

Global trade fears keep South Africa’s interest rates on hold 20 Mar 2025 Kganyago unpacks R100bn reserve fund withdrawal 31 Jul 2024 The MPC has held the repo rate steady - now what? 18 Jul 2024 High Street Auctions: Signs point to post-election real estate recovery 5 Jun 2024 How an election-packed 2024 is shaping up for world markets 10 Apr 2024 #SARBMPC: High Street Auctions director cites challenges for property sector revival 28 Mar 2024