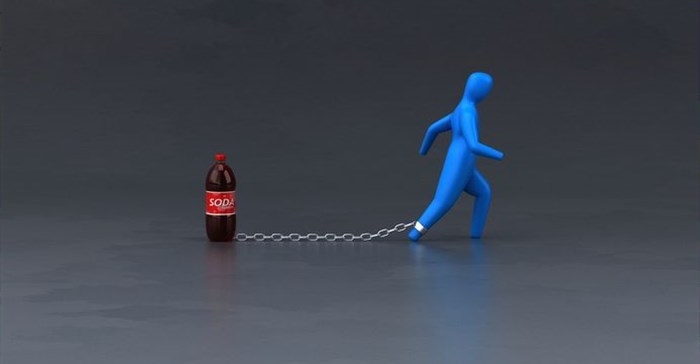

The initial consideration behind the sugary beverages levy (SBL) was as a deterrent to reduce lifestyle diseases such as diabetes and obesity, but it's potentially evolving into a money spinner for the South African Revenue Services (Sars).

“Was sugar tax really introduced to change South African’s behaviour to a healthier lifestyle or is it to create an additional revenue stream for the fiscus, given that it has not even covered a small percentage of available sugary foodstuffs? Given that it is the first fiscus financial year of collecting SBL, we will be expecting some feedback during the tabling of the 2019 Annual Budget Speech on 20 February 2019 as to whether the SBL succeeded in its policy, that is, in changing consumption behaviour," says Madelein Grobler, South African Institute of Chartered Accountants (Saica) project director: tax.

"Analysing National Treasury’s monthly revenue reports until December 2018, the levy is bound to outperform all other tax collections with regard to growth estimations, substantially exceeding the initial R1.685bn estimated. It is predicted that Sars will collect 90% more SBL than initially anticipated, ending up with a total of R3.2bn. To put that in context, that is more than the budgeted 2019 revenue from donations tax and estate duty combined. In comparison to other behavioural taxes for 2019, it is more than the aggregate of all of the plastic bag levy, Universal Service Fund, levies on financial services, CO2 motor vehicle emissions, incandescent light bulb levy, tyre levy and International Oil Pollution Compensation Fund,” she says.

Successful models

While considering the introduction of SBL, National Treasury looked into other international jurisdictions to determine the impact of fiscal measures used. It seems like Mexico was most successful with their sugar tax levy decreasing taxed beverages by an average of 6% after implementation during 2014.

Various sources noted that the SBL would on average increase a soft drink can’s retail cost by 11%, giving effect to the fiscal policy to influence consumer behaviour when purchasing. However, manufactures and retailers may have diluted this initiative by reducing the volume of the product by 10% (a can of Coke nowadays is 300ml instead of 330ml).

At a first glance, and compared to Mexico, South Africa seems to have been successful, given that the reduction in volume reduced sugar intake, for example a can of coke has now 9% less sugar. However, the question remains whether South African’s behaviour has changed by living a healthier life in overall sugar consumption?

If physical activity of South Africans was a measure, it is highly unlikely. It has been noted in a recent study by the World Health Organisation that 38.2% of South Africans don't get enough exercise.

Shift in behaviour needed

A person’s sugar intake is but one factor to be considered, when determining the reasons for being overweight and obese. The Lancet Global Health Journal's study published in September 2018 noted that insufficient physical activity is a leading risk factor for NCDS.

The effectiveness of the policy will have to be measured on overall sugar consumption otherwise it would merely be an additional revenue stream. This is even more so as the taxes collected via the SBL is not ring-fenced to specifically target awareness and/or combat NCDS in South Africa, but rather to cover general costs of the fiscus. A shift in cultural behaviour is probably required in getting South African’s healthier rather than just having a levy on a single sugary dietary source,” says Grobler.