Subscribe & Follow

#AfricaMonth

Jobs

In the news

Global passenger demand data shows strong climb for August

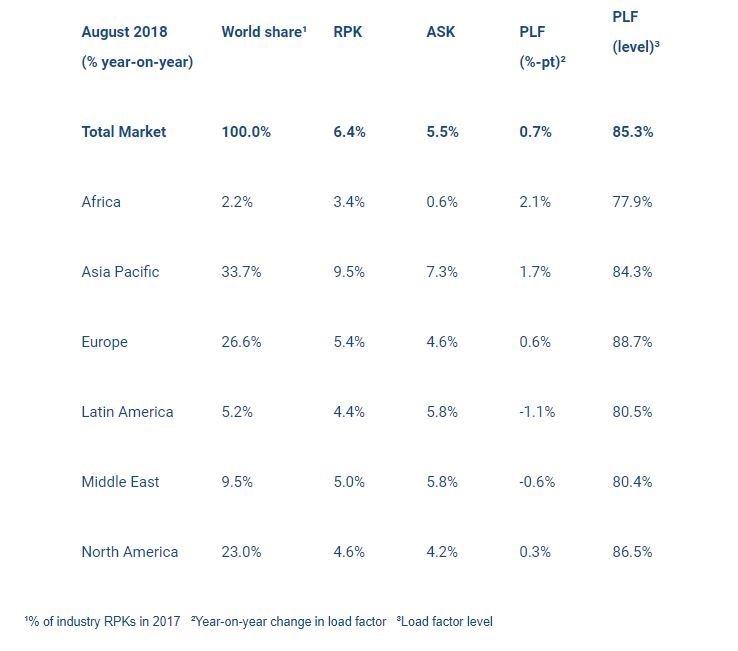

August’s capacity (available seat kilometers or ASKs) increased by 5.5%, and load factor climbed 0.7% percentage point to 85.3%, which was the highest for any month since at least 1990.

"The industry experienced continued strong traffic growth in August, putting the cap on a very good peak travel season. The all-time record load factor reflects that airlines are maximising the efficiency of their assets at a time of rising fuel prices and other costs that are limiting the opportunities for low fare stimulation," said Alexandre de Juniac, IATA’s director general and CEO.

International passenger markets

All regions recorded increases, led by airlines in the Asia-Pacific region. Capacity climbed 5.1%, and load factor edged up 0.4 percentage point to 85.0%.

Asia-Pacific airlines’ August traffic increased by 7.5% compared to the year-ago period, which was an acceleration compared to a 7.2% rise in July. Capacity rose 6.1% and load factor rose by 1.1 percentage points to 82.6%.

The upward trend in passenger traffic remains strong, supported by structural changes, including ongoing rises in living standards in the region, as well as more route options for passengers that translate into time savings and ultimately stimulate demand.

European carriers saw the August demand climb by 5.1% year-to-year, which was also an increase from the 4.5% growth recorded in July.

However, in seasonally-adjusted terms, growth has tracked sideways since late spring. Capacity rose 4.5%, and load factor climbed 0.5 percentage points to 88.9%, which was the highest among regions. European demand is being affected by mixed signs on the economy as well as possible disruptions from air traffic control strikes.

Middle Eastern carriers posted a 5.4% traffic increase in August, which was a slowdown from 6.2% in July. Passenger volumes trended upwards at an 8% annualised rate since the start of the year. Capacity increased by 6.3%, with the load factor slipping by 0.7 percentage points to 80.7%.

North American airlines’ international demand rose by 3.7% compared to August a year ago. While this was a slowdown from 4.1% growth recorded in July, this largely reflected developments a year ago rather than any change in the current healthy trend. Capacity rose by 3.3%, and the load factor grew by 0.4 percentage points to 87.2%.

Latin American airlines experienced a 4.8% demand increase in August compared to the same month last year, up from 3.5% annual growth in July. Capacity increased by 6.5% and load factor slid down by 1.3 percentage points to 81.4%. Year-to-year comparisons are distorted by the hurricane-related disruptions of a year ago, and traffic has largely tracked sideways since April in seasonally adjusted terms.

African airlines’ traffic climbed by 6.8% in August. While this was a slowdown from the 7.4% growth recorded in July; the bigger picture is that demand remains strong, despite an increasingly challenging environment in the continent’s largest economies. South Africa slipped back into recession in the second quarter and business confidence in Nigeria has moderated in recent months. Capacity rose by 3.8%, and load factor surged up by 2.2 percentage points to 78.2%.

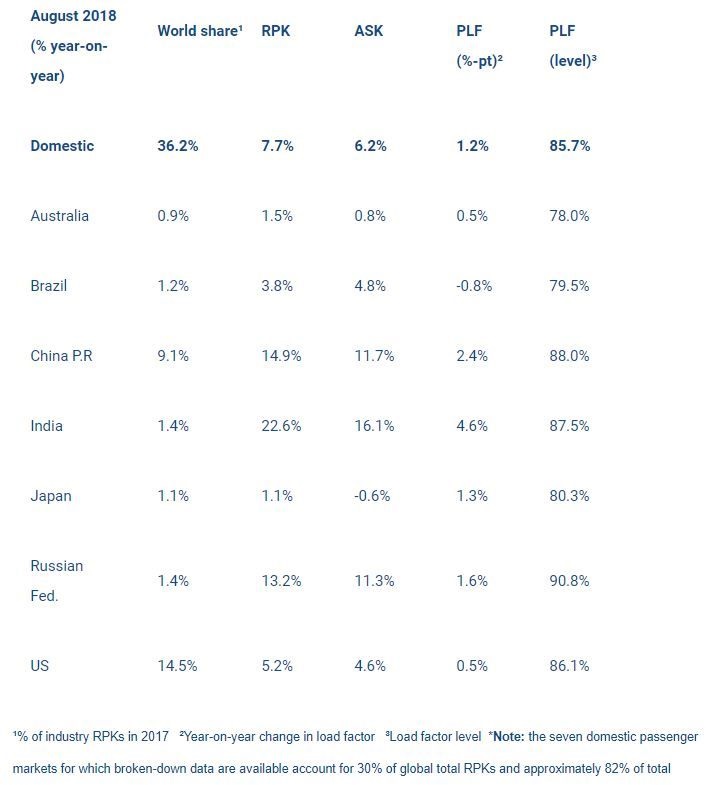

Domestic passenger markets

Demand for domestic travel climbed by 7.7% in August compared to August 2017, up from the 7.2% growth recorded in July. Capacity rose by 6.2% and load factor increased by 1.2 percentage points to 85.7%. All markets reported demand increases albeit with wide variation.

• Indian airlines achieved their 48th consecutive month of double-digit traffic growth as demand rose 22.6%. Traffic continues to be stimulated by sizeable increases in the number of domestic routes served.

• China airlines’ domestic traffic climbed 14.9% in August, which was a four-month high. In both China and India, huge demand increases are being supported by rising living standards and large increases in the number of flight choices.

The Bottom Line

"Aviation is the business of freedom, reuniting friends and families and connecting businesses to markets. To preserve that freedom, air links need to be maintained. For that reason, it is absolutely critical that UK and EU aviation negotiators achieve a post-Brexit agreement. It is not just about permission for flights to take off and land. Everything from pilots’ licenses to security arrangements, and much more besides, needs to be agreed upon.

Mutual recognition of existing standards can address much of this, but we cannot wait until the eleventh hour. An assumption that ‘it will be all right on the night’ reveals little understanding of the complexities involved. Preparations should be made for every contingency, in an environment of far greater transparency than we have seen to date," said de Juniac.

Related

Global air travel rises in February despite domestic decline 1 Apr 2025 Qatar Airways increases flight frequency to multiple global destinations 11 Mar 2025 Iata reports 10% rise in global passenger demand 6 Mar 2025 Emirates launches its first Airbus A350 aircraft 28 Nov 2024 SAA's economic impact to reach R32bn by 2030, report reveals 28 Nov 2024 King Shaka Airport boosts regional connections with expanded flight network 25 Nov 2024