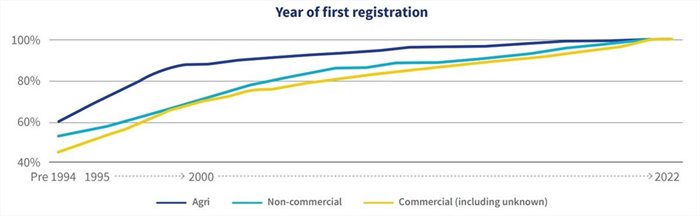

Following a busy five years between 1994-1999, first registration of agricultural stock at the South African Deeds Office has risen by just 10% since then. According to Lightstone, some 60% of current agricultural stock had been initially registered at the South African Deeds Office before the country's first democratic elections in 1994.

Lightstone Property’s head of digital, Hayley Ivins-Downes, says non-commercial registrations grew off a lower base and followed a gentler but more sustained growth trajectory than agri, slowing in the mid-2000s, while the highest proportion of commercial registrations have taken place since 1994.

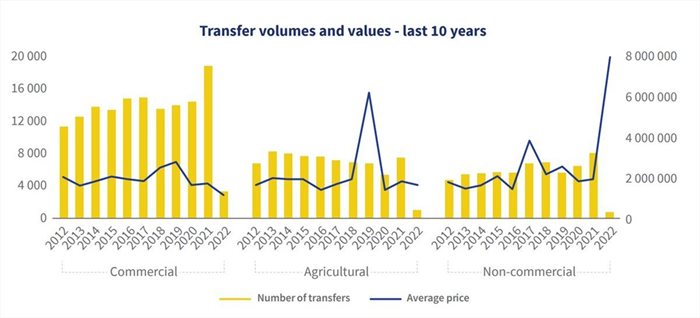

As expected, the greater number of first registration of commercial properties results in more transfer volumes than in non-commercial and agricultural (see graph below).

Transaction volume increases and declines tell a clear story, but average value fluctuations need to be treated with some caution: single-year spikes in average prices are almost certainly attributable to the stock type makeup of the transactions – for example, a year dominated by small farm transfers followed by a year dominated by a large farming operation transfer.

When a trend becomes apparent, such as the sustained decline in commercial prices, it may be more indicative of less stock activity because of Covid-19 than of actual value decline. `

Ivins-Downes says, however, that overall, there has been little value growth realised in these markets. Covid dampened agricultural market activity levels substantially, although volumes had been falling since 2014. Commercial and non-commercial activity levels continued to see uneven growth.

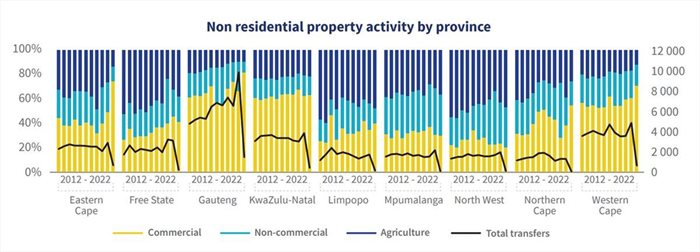

As would be expected, volumes are highest in Gauteng, with provinces with large metropolitans skewed towards commercial activity while rural provinces naturally had more agricultural activity.

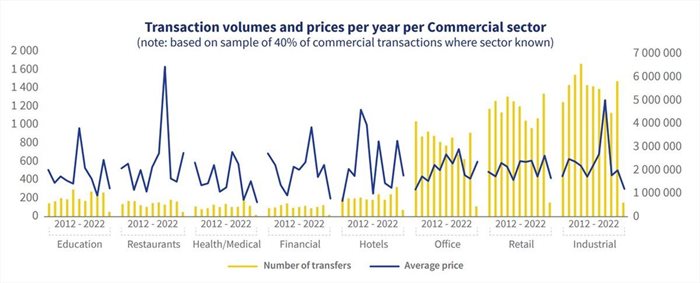

90% of the commercial sample where the sector is known falls within one of eight sectors. Ivins-Downes says analysis of this eight-sector sample over the last 10 years shows transaction volumes are highest in the industrial sector, followed by retail and then offices.

While average values were reasonably volatile across the years in most sectors, it is notable that ‘office’ prices were on a steady growth trajectory until Covid, when they plummeted (though volumes increased in 2021, reversing the negative volume trend, possibly as no longer wanted office space was sold off into other sectors). The small volume of 2022 year-to-date (YTD) office sector sales do show a promising price recovery.

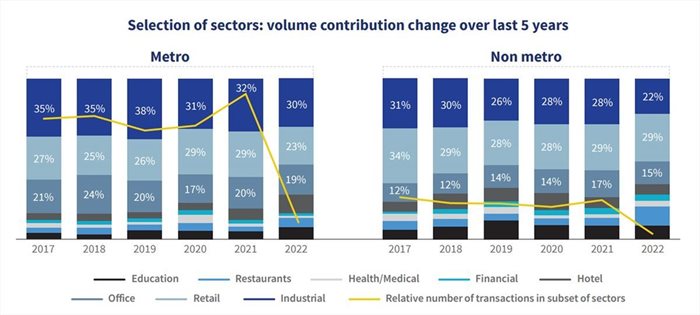

Considering the same volume (not price) component of the information as above but limited to the last five years and split between metropolitan-focused provinces (Gauteng, Western Cape and KwaZulu-Natal) against rural-focused provinces (the other six provinces), Ivins-Downes says we see roughly 75% of transfers in all the commercial sectors are within the metropolitan provinces.

“Sector share of activity has largely remained static, with some notable exceptions: the medical sector’s small share of activity swelled in metropolitan areas but declined in non-metropolitan areas in 2020, while hotel activity in rural areas increased its share of activity at the same time and restaurants are seeing a strong contribution to activity in 2022 YTD, although it is unknown if it is positive renewal or negative selloff,” she says.