Billionaire businessman Patrice Motsepe's African Rainbow Capital (ARC) has made its first foray into property, buying a 20% stake in Val de Vie Investments, which is expanding a high-end residential estate in the Western Cape.

Many investment companies are buying interests in listed property funds, or investing in real estate directly for the first time, as they look to gain exposure to the burgeoning sector.

Ian Anderson, chief investment officer at Grindrod Asset Management, said maiden moves for South African property assets were no surprise.

"Globally, investors have been on the hunt for institutional quality property so, it is not surprising that it is starting to happen in SA now. This is one of the reasons why cap rates on high-quality assets have been falling all over the world. There is excess demand from investors wanting the relative safety of a strong covenants, long leases and well-located properties."

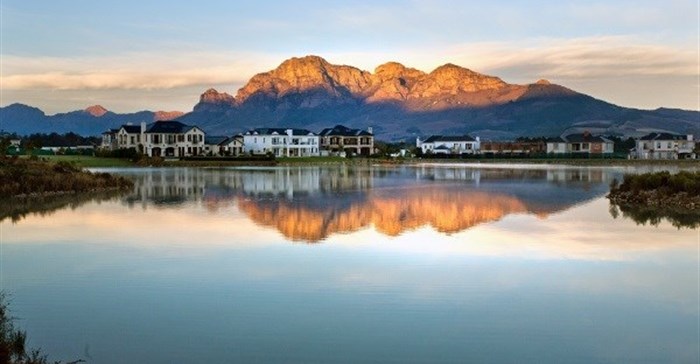

The residential development, Val de Vie Estate, is located in Paarl and is undergoing a major expansion to include a further 300ha of land.

ARC is an unlisted company that is headed jointly by Johan van der Merwe, former CEO of Sanlam Investments, and Johan van Zyl, former CEO of Sanlam. It is a subsidiary of Sanlam's empowerment partner, Ubuntu-Botho Investments. Van Zyl and Van der Merwe have both signed on to be co-CEOs for a 10-year period. ARC has been given about R10bn to invest in various sectors. Of this, about R1.5bn will be earmarked initially for property investments.

"This 20% deal is our first property play. We see it as a strong opportunity to gain exposure to a very well-run company. We really like the management team at Val de Vie Investments," Van der Merwe said.

He did not disclose the exact value of the 20% stake, but said it was worth R100m-R200m.

The investment company was planning to make another real estate acquisition in the near future that would be worth between R500m and R1bn.

"We want to have an exposure of about R1.5bn to property assets by the end of this year," Van der Merwe said.

"This deal will support future developments on and around the estate, such as the construction of a bridge over the Berg River that will connect with the R45 provincial road."

Motsepe, who is the chairman of ARC, said Val de Vie was an exciting investment. "We see immense value in Val de Vie, and are pleased to be involved with this world-class development and its visionary team."

Source: BDpro