While geopolitical uncertainty as a result of Russia's war with Ukraine has sent shockwaves through economies around the world, locally, successive interest rate hikes have had a significant impact on affordability and highlighted the importance of prudent budgeting, says Carl Coetzee, CEO of BetterBond.

Carl Coetzee, CEO of BetterBond

“The residential property market has once again proven its resilience and buyer activity in some price segments and property sectors remains robust,” says Coetzee.

This is reflected in the bond originator's registration volumes which have held steady above pre-2020 levels. “Furthermore, our bond approval ratios are up 2.01% for November year-on-year, with an improvement in the approval ratio for first-time buyers of 1.44%.”

Adds Coetzee: “BetterBond expects house prices to soften over the next few months as we reach the peak of the rates’ hike cycle. But there is still a steady demand for bonds across price bands and regions which suggests that property is proving to be an investment safe haven during challenging economic times.”

Looking ahead, he identifies key trends for the housing market in 2023:

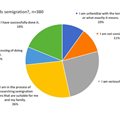

1. Semigration will gain momentum and possibly also change direction. Lightstone has reported a significant relocation of buyers aged 46 and upwards who can afford to make the move to a new city or province, particularly the Western Cape. Semigration numbers are up to 35% for the past year, from 31% in 2020, with most of the people moving being between the ages of 49 and 64.

Buyers in the 36 to 49 age group making lifestyle changes also opt to relocate, notes Lightstone. “About 20% of buyers moving to the Western Cape will move to a property that is larger in size, but lower in value,” says Coetzee.

“Interestingly, we are also seeing a partial return of buyers, particularly at the upper end of the market, to parts of Gauteng. Many of these settle in estates that offer security and an appealing lifestyle.” Applications for bonds from buyers in Johannesburg North West and South East make up the bulk of BetterBond’s bond applications for November.”

Ndalo Matloha, KLA 13 Dec 2022

The relocation of particularly older buyers - “silver-semigration” - to smaller towns along the Garden Route, Whale Coast and Cape Winelands will continue. Lightstone data (November 2022) shows that most of the people leaving their home provinces are choosing the Western Cape as their destination. As Lightstone reports, although 46% of these buyers will opt for smaller homes as they downsize, the value may be greater.

2. Sectional title remains a drawcard. “We have seen significant interest in sectional title properties in the past few years, accounting for between 37% and 44% of stock value, according to Lightstone,” notes Coetzee.

Almost a third of all property sales are for sectional title properties, with many of these going to first-time buyers investing in new developments. Meanwhile, property data shows that the volume of transfers of freehold homes has been dropping steadily over the past five years.

3. Sustainable living is on the rise. Buyers want homes that provide convenience, sanctuary and sustainability. According to research from GWI, smart home product ownership has increased by 41% worldwide since 2019. Home automation - from blinds and lights to appliances - makes modern living easier.

“Escalating load shedding and rising electricity costs has pushed alternative energy supply to the top of the home wishlist for many buyers. Solar energy options, boreholes, and other green features that can help reduce utility costs will add value to the home in the long-term.”

Many companies and businesses have embraced a hybrid working model, so homes that accommodate a home office and provide reliable internet connectivity remain sought after.

The demand for estate living will continue as security becomes even more important, especially for buyers with families. “The pandemic highlighted the importance of being able to enjoy amenities and recreational activities within a controlled environment. In Gauteng, particularly, there has been a steady increase in the value of estate homes,” says Coetzee.

4. Micro-living takes the notion of lock-up-and-go a step further by offering urban homeowners a minimalist lifestyle. The Uxolo development in Cape Town’s city centre, for example, has 35 units ranging in size from 24m2 to 40m2, making this an ideal option for young professionals. According to the State of Cape Town Central City Report published by the Cape Town Central City Improvement District (CCID), most of the residents of CBD apartments are between the ages of 25 and 34.

“Micro-unit developments are often mixed-use, offering residents access to restaurants, shops and other amenities within the building,” says Coetzee.

5. Multi-generational living remains an option for extended families seeking to pool their resources to deal with rising living costs. “For many buyers, a home with some extra space for a granny flat or a cottage that could accommodate elderly parents or older children is a must-have.”

6. Digital innovation will be key in 2023. The use of proptech to help companies manage, sell and buy property will continue to innovate. Global investment in proptech has shot up by 28% since 2020, according to the 2021 Real Estate Tech Venture Funding Report, as more consumers opt to transact online. Locally, the value of investment in proptech hit the $6m mark in the first half of this year, reports data portal Statista.

Notwithstanding the economic and social challenges that marked 2022, there are some glimmers of hope to look forward to. “Already, the economy has defied expectations with a larger than expected growth in the third quarter of this year. Furthermore, the Reserve Bank responded timeously to inflationary pressures and its hoped that it will be enough to bring it back in line with midline targets so that we can start to see interest rates stabilise and even drop by the end of 2023,” concludes Coetzee.