In the news

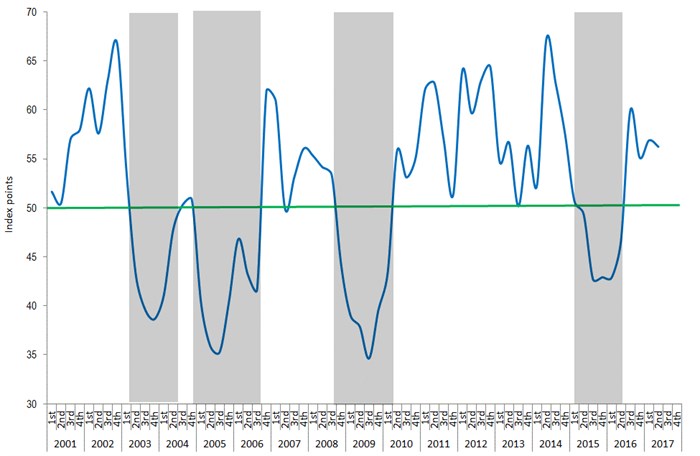

Agbiz/IDC Agribusiness Confidence Index down, but points to continued recovery from drought

Source: Agbiz Research(Shaded areas indicate periods when the confidence index was below 50 points)

Amongst the ten sub-indices making up the Agbiz/IDC Agribusiness Confidence Index, the capital investment, market share, employment, the volume of exports and debtor provision for bad debt sub-indices were the key underlying drivers of the sustained optimism in confidence in the second quarter of 2017. The general improvement in these particular sub-indices is partly in line with the robust recovery in agricultural production, particularly summer grains and oilseeds.

Meanwhile, the decline in other sub-indices, namely turnover, net operating income, economic growth, general agricultural conditions and financing cost, all of which mirror the tail-end effects of the 2016 drought, particularly businesses operating in the horticulture, wine, and insurance industries.

Discussion of the sub-indices

Confidence regarding the turnover sub-index declined by 11 index points in the second quarter to 61. This shows an expectation of lower profitability relative to the previous quarter, particularly for agribusinesses operating in the horticulture, wine and insurance industries, as noted above. For horticulture agribusinesses with farms that harvest in the first few months of the year, volumes were down due to the 2016 El Niño-induced drought. Moreover, the insurance business received a high volume of claims following the drought, which eventually weighed on their financial standing.

In a similar trend with the turnover sub-index, confidence in net operating income sub-index marginally declined by one index point to 68 in the first quarter.

The perception in the market share of the business sub-index improved by two index points from the previous quarter to 68. These results reflect the potential benefits of the 2017 summer rainfall, particularly in certain grain operating businesses which recently allowed farmers to deliver maize to silos with relatively higher moisture levels.

The perceptions regarding employment in the agricultural sector improved in the second quarter of this year from the previous one. The sub-index reached 59 points, up from 56. This suggests the improved expectation of seasonal employment as some horticulture and grain farms begin the harvest period, which requires more labour.

Despite policy uncertainty in the country, the farming community continues to invest in agricultural equipment such as tractors and combine harvesters, amongst others. This trend is likely to continue with agribusinesses’ perception regarding capital investment up by six points from the previous quarter to 62.

Confidence in the export volumes sub-index improved by three index points from the previous quarter to 58. This is largely on the back of expected large grains and oilseed supplies. The 2017 summer grain and oilseeds production levels are set to reach 18.03 million tonnes, which is a 92% annual increase.

Although the survey was conducted before the release of recent GDP figures – which put South Africa in recession in the first quarter of 2017 – confidence regarding economic conditions was down by five points from the previous quarter to 45. This reflects relatively downbeat expectations for overall economic growth performance this year.

The general agricultural conditions sub-index declined by five index points in the second quarter of this year to 64. This is largely underpinned by unfavourable dry weather conditions in the Western Cape province - which is a key producer of winter grains, horticulture products, and wine.

Agribusinesses survey suggests that the provision for bad debt might decline in the second quarter of 2017, which shows an expectation that bad debt might decline this year. The expected decline in bad debt is underpinned by expected large harvests in most areas of the country. The debtor provision for bad debt sub-index eased at 39.

The financing costs sub-index was up by four index points in the second quarter of this year to 33. To some extent, this is due to expectations of higher costs of servicing debt after the recent credit rating downgrades.

Index paints an encouraging picture

The second quarter 2017 Agbiz/IDC Agribusiness Confidence Index paints an encouraging picture of the South African agricultural sector. “While many sub-indexes within the Index showed different movements, the key underlying factor behind this sustained optimism is the improvement in weather conditions, particularly the recent summer rainfall and its impact thereafter on crops,” says Wandile Sihlobo, Agricultural Economist at Agbiz. With that said, unfavourable weather condition in the Western Cape province remain a key risk that could potentially change this picture altogether.

Next release, 17Q3, will be at 10am, Monday, 4 September 2017.