Subscribe & Follow

#AfricaMonth

Jobs

- Motor Accounts Handler / Office Bound Business Developers George

- Contact Centre Agents George

- Business Analyst - Chat Commerce Specialist George

- Creditors Clerk (Accounts Payable) West Rand

- ML Engineer George

- Marketing Specialist - Pet George

- Finance and Admin Administrator Tshwane

- Short Term Claims Manager Tshwane

- Claims Operations Manager Tshwane

- Vet Practice Business Development Consultant Gauteng

In the news

Reshuffle adds to policy uncertainty

This is reflected in the fall of the rand, which although so far not as bad as what happened after 'Nenegate', was also influenced by the fact that the financial markets were expecting certain cabinet changes and had already partially priced them in.

The rand, nonetheless, remains weak and vulnerable, and investor confidence has been badly shaken again. Policy uncertainty has inevitably risen and this is not helpful for encouraging the private fixed investment that South Africa needs to grow more rapidly.

The surprise is that the finance portfolio unexpectedly went to Minister Malusi Gigaba who - with no obvious previous background in finance, economics or business - will now be on a steep learning curve to master the complexities of fiscal policy. He will have big shoes to fill.

Fending off junk status

Gordhan had come to enjoy the confidence of many key stakeholders in the economy and abroad and - together with business and labour - was instrumental in fending off junk status for the country. The damage to trust and confidence in these important relationships will need to be repaired if South Africa’s economic performance is to continue to successfully mobilise collaborative effort.

The financial markets as well as the credit rating agencies will also be expecting to see conservative fiscal policies still being followed and that the anti-patronage stance taken by former Minister Gordhan will be upheld. Unfortunately, there are fears and suspicions that the new political team at the Treasury may not do so, and that fiscal probity will become a victim of political factionalism.

NDP at risk

The danger is also that the credibility of the National Development Plan will be put at risk. The onus will therefore be on Gigaba and deputy minister Buthelezi to win the confidence of the both foreign and domestic investors by following policies and making decisions which are clear, ethical, consistent and growth-oriented.

The risk of an investment downgrade in June has also risen in the aftermath of the Cabinet reshuffle. The recent concerns of the credit rating agencies about the SA economy have revolved exactly around the market doubts generated by the removal of Gordhan and Jonas from their posts in present circumstances.

And unless the currency stabilises soon, the hope expressed in the latest MPC statement by the SARB governor yesterday that interest rates may have peaked and rates might be cut soon will also be jeopardised. In any case, it would probably be prudent for analysts to revisit current forecasts of South Africa’s economic performance in 2017 to see whether they need updating in the light of the latest political developments.

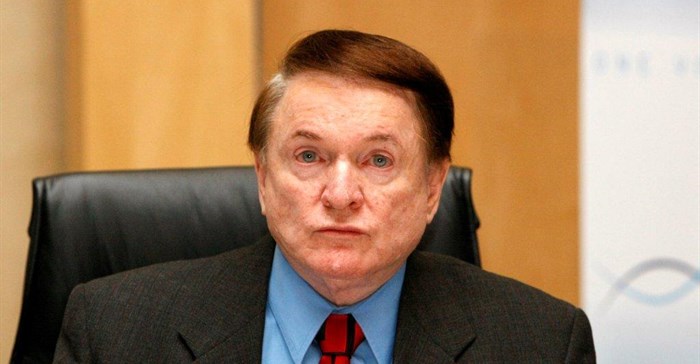

About Raymond Parsons

Raymond Parsons is a professor at the North-West University School of Business.Related

MTN chair Mcebisi Jonas tapped to strengthen SA-US relations 14 Apr 2025 North-West University Business School Prof Raymond Parson comments on 4Q 2024 GDP growth figures 7 Mar 2025 Government urged to push structural reforms as South Africa's GDP grows 0.6% 5 Mar 2025 SA's Budget delay: National Treasury's next steps and fiscal risks 19 Feb 2025 The impact of Donald Trump’s re-election on the SA economy 12 Nov 2024 Post-Trump election: Emerging economies on edge 7 Nov 2024