Trending

Elections 2024

Jobs

- Receptionist Cape Town

- Reception / Administrator Atlantic Seaboard

- HR Administrator George

- Model Booker Cape Town

- Sales Agent Cape Town

- Payroll - Senior Administrator Johannesburg

- Payroll Accountant George

- Contract Assessors Remote

- Onboarding Manager Cape Town

- Recruitment Specialist - 360 George

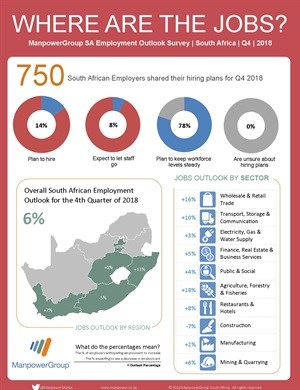

SA employers still cautious on the hiring front

Once the data is adjusted to allow for seasonal variation, the Outlook also stands at +6%. Hiring intentions are unchanged when compared with the previous quarter, and remain relatively stable in comparison with 4Q 2017.

Lyndy van den Barselaar, managing director of ManpowerGroup SA, provides insights into why South African employers are reporting conservative hiring intentions for the October to December time frame: “South Africa’s economy continues to be weighed down by slower-than-expected economic growth, which can translate into employers being cautious about hiring and spending-related activity, especially in the run up to the year-end holiday season. This is reflected in the fact that 78% of responding companies are expecting to make no change in their hiring strategies in the last quarter of the year,” she explains.

Regional comparisons

Payrolls are forecast to increase in three of the five regions during the final quarter of 2018. KwaZulu-Natal employers report favourable hiring prospects with a Net Employment Outlook of +13%, while employers in both Gauteng and Western Cape report encouraging signs for job seekers with Outlooks of +8% and +7%, respectively. However, Free State employers anticipate a flat labour market with an Outlook of 0%, while Eastern Cape employers expect to trim payrolls, reporting an Outlook of -5%.

“The province of KwaZulu-Natal continues to be a focus for investment and projects that are expected to boost the economy and create employment. For example, pulp and paper giant Sappi has announced major planned upgrades at its Saiccor Mill in Umkomaas, Durban, which will be worth R7 billion. The investments are reported to include a R2,7 billion capacity expansion project and a planned R5 billion investment over five years in various continuous improvement initiatives and upgrade projects,” explained van den Barselaar.

“These kinds of investments would certainly be expected to create further employment opportunities in the region. Once again, it is surprising that further employment from these projects have not been reflected in the forecast for the construction sector, in the coming quarter,” she added.

In comparison with 3Q 2018, Gauteng employers report a moderate improvement of 5 percentage points, while Outlooks are 3 and 2 percentage points stronger in Western Cape and KwaZulu-Natal, respectively. However, Eastern Cape employers report a considerable decline of 10 percentage points, and the Outlook for Free State is 6 percentage points weaker.

Hiring prospects strengthen in both KwaZulu-Natal and Gauteng when compared with this time one year ago, increasing by 8 and 2 percentage points, respectively. Meanwhile, Eastern Cape employers report a decrease of 7 percentage points, and the Free State Outlook declines by 4 percentage points.

Sector comparisons

Job gains are forecast in nine of the 10 industry sectors during the coming quarter. The strongest labour market is anticipated in the Agriculture, Hunting, Forestry & Fishing sector, where employers report a Net Employment Outlook of +18%, and steady payroll gains are also forecast for the Wholesale & Retail Trade sector, with an Outlook of +16%. Elsewhere, Transport, Storage & Communication sector employers report moderate hiring prospects, with an Outlook of +10%, while some workforce gains are anticipated in both the Restaurants & Hotels sector and the Mining & Quarrying sector, with Outlooks of +8% and +6%, respectively. However, Construction sector employers forecast a sluggish labour market, reporting an Outlook of -7%.

“South Africa’s agricultural sector over the short- to medium-term is now beginning to experience some growth again. It was recently reported that wine and wool exports, especially to China, have offered the sector some relief; as have an increase in international prices, which lent support to domestic pork and poultry prices,” said van den Barselaar. “The expected growth in the Wholesale & Retail Trade sector are also typical of the last quarter of the year, as consumers begin to spend and buy more, leading up to the festive season.”

In comparison with 3Q 2018, hiring intentions strengthen in four of the 10 industry sectors. Considerable improvements of 13 and 12 percentage points are reported for the Agriculture, Hunting, Forestry & Fishing sector and the Wholesale & Retail Trade sector, respectively, while Outlooks are 3 percentage points stronger in both the Mining & Quarrying sector and the Restaurants & Hotels sector. However, employers report weaker hiring plans in four sectors, most notably with considerable declines of 10 percentage points in both the Electricity, Gas & Water sector and the Transport, Storage & Communication sector.

Hiring prospects weaken in five of the 10 industry sectors when compared with this time one year ago. Construction sector employers report a considerable decline of 11 percentage points. Elsewhere, the Manufacturing sector Outlook is 6 percentage points weaker, and Outlooks decrease by 4 percentage points in both the Electricity, Gas & Water sector and the Restaurants & Hotels sector. Meanwhile, hiring plans strengthen in four sectors, including a sharp increase of 21 percentage points reported for the Agriculture, Hunting, Forestry & Fishing sector. Wholesale & Retail Trade sector employers report an improvement of 12 percentage points, and the Outlook for the Mining & Quarrying sector is 8 percentage points stronger.

Organisation-size comparisons

Participating employers are categorised into one of four organisation sizes: Micro businesses have less than 10 employees; Small businesses have 10-49 employees; Medium businesses have 50-249 employees; and Large businesses have 250 or more employees.

Employers forecast workforce gains in all four organisation size categories during the next three months. Large employers report the strongest hiring intentions with a Net Employment Outlook of +20%. Elsewhere, some payroll gains are likely in the Medium-size category, where the Outlook is +6%, and also for Micro- and Small-size employers, with Outlooks of +3%.

In comparison with the previous quarter, Large employers report an improvement of 3 percentage points. Meanwhile, Outlooks remain relatively stable for Medium- and Micro-size employers, while Small employers report no change.

Year-over-year, hiring prospects strengthen by 4 percentage points for Micro firms, while Small employers report an increase of 2 percentage points. However, Medium employers report no change, while the Outlook for Large employers declines by 3 percentage points.

Global confidence

Globally, fourth-quarter hiring confidence is strongest in Japan, Taiwan, the US, Romania and Slovenia, while the weakest hiring prospects are reported in Switzerland, Argentina, France and Italy.

ManpowerGroup’s fourth-quarter research reveals that some job gains are expected in 43 of 44 countries and territories during the October-December time frame. However, there is little evidence of notable surges in hiring activity. Overall employer confidence is little changed from prior quarters and most employers remain resilient, appearing content to engage in modest levels of hiring activity against a backdrop of challenges associated with a realignment of global trading partners and on-going tariff negotiations.

Fourth-quarter hiring plans strengthen in 22 of 44 countries and territories when compared to the July-September time frame, weaken in 14 and are unchanged in eight. When compared to last year at this time, Outlooks improve in 23 countries and territories, weaken in 13 and are unchanged in seven.