Subscribe & Follow

#AfricaMonth

In the news

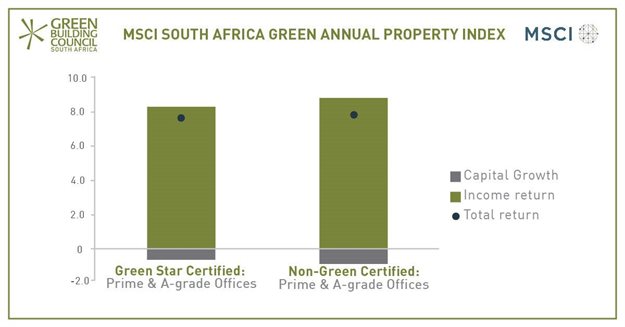

MSCI Green Annual Property Index reveals higher return in case of green-certified properties

Chief development and investment officer at Growthpoint Properties Rudolf Pienaar said, “The latest index indicates a significantly higher return in the case of green-certified office properties, based on lower vacancy rates and higher net income per square metre. The outperformance is further based on a lower discount rate, offering green-certified office investors lower risk investments; an aspect to definitely focus on in this property market.”

For the three-year period the green-certified office sample delivered an annualised compound total return of 10.3% versus the 7.2% of the non-certified sample. Green Star-certified office buildings delivered an inflation-beating total return of 7.6% in the same period. Key drivers of green-certified building performance include substantially lower vacancy rates and higher net income per square metre of space.

This performance has been driven by a higher capital growth, as a result of a superior net income growth and a lower discount rate - meaning that valuers’ view green-certified office properties as a lower risk investment.

Results

Released by MSCI on 4 July 2019 at a GBCSA member event, the index results reinforced the association between quality and green-certified buildings, as reflected by a higher capital value per square metre, more resilient capital growth and slightly lower income returns than the non-certified office buildings.

That said, the returns of certified and non-certified buildings were remarkably similar with only a 0.2% premium spread in favour of non-certified buildings over the period measured.

“The similarity in returns may indicate that adoption of green principles is now a matter of course across higher quality offices, whether certified or not. However, a deeper look into the fundamentals over the three-year period continues to endorse the argument that green-certified offices provide a lower risk investment, particularly during the down phase of the cycle, as reflected by their lower discount rates, markedly lower vacancies and higher net incomes per square metre,” said MSCI executive director Phil Barttram.

Findings from the analysis showed that capital expenditure stood at 0.7% of capital value for Green Star-certified buildings, versus 1.1% of capital value for uncertified buildings. This means that green-certified buildings have required comparatively less capital expenditure which has enhanced capital growth relative to the non-green sample.

In addition, while net income growth for 2018, at 2.4%, was on par for certified and uncertified buildings, the net income from green-certified buildings outperformed their uncertified peers by some 16.5% per square metre per month. On a three-year basis, the green-certified office sample has delivered a net income growth outperformance of 80bps compounded per annum. Furthermore, the Green Star-certified prime and A-grade office sample managed to recover 119.5% of its electricity expense versus the 104.9% of the non-certified sample.

Growth of green buildings

According to the GBCSA, it first developed the Green Star SA rating tools to provide an objective measurement for green buildings across South Africa and the rest of the continent. These tools recognise and reward environmental leadership in the property industry, supporting design professionals and developers in creating a better built environment for both people and planet.

Since inception, the number of certified buildings has grown rapidly and consistently. The MSCI South African Green Annual Property Index examined 96 Green Star-certified properties in 2018, compared to 85 buildings in 2017, which at the time were valued at some R20.4bn. In the previous year, there were 49 certified properties on the list.

“We are pleased to continue to sponsor the MSCI South Africa Green Annual Property Index, a collaboration between MSCI and the Green Building Council of South Africa. Investors are keen to determine whether the capex spend on developing green buildings, actually shows acceptable returns," concludes Pienaar.

Related

Municipalities enter the climate crisis chat at built environment indaba 9 Dec 2024 Growthpoint wins big with four green building awards at #GBCSA2024 13 Nov 2024 Zero Positive: #GBCSA2024 champions climate-integrated construction solutions 6 Nov 2024 UCT’s d-school Afrika reaffirms leadership with second 6-Star Green Star rating 15 Oct 2024 Growthpoint begins construction on CT green office refit for Ninety One 26 Jul 2024 Six-star green neighbourhood, Newinbosch, ticks all the boxes 30 Apr 2024