Arab TV springs to life: Pay TV subscribers to top 10 million in 2012

LONDON, UK: Record numbers of households across the Middle East and Africa are signing up for pay TV, according to new research from Informa Telecoms & Media.

In 2000 there were just over 2.5 million pay TV subscribers across the MENA region. By the end of last year that total had more than trebled to 9.2 million and Informa's research shows it is heading for 9.6 million by the end of 2011 and will pass the 10 million mark next year.

"Until now, pay TV has been very much targeted at affluent demographics, either wealthy locals or well-paid foreign workers" says Adam Thomas, Informa's Media research manager. "But services like Al Jazeera Sport are increasingly putting the cost of pay TV within the grasp of the mass market. If you add to that the Arab Spring movement, with one of its aims being to close the income disparity gap, then you have a situation that is increasingly positive for pay TV."

Lack of broadband penetration limits IPTV progress

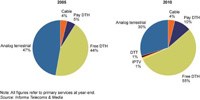

Satellite, both pay and free-to-air, remains the dominant platform in the region (see fig) and there has been only limited cable and IPTV activity although IPTV, in particular, is growing fairly quickly, albeit from a very low base. Some fibre upgrades are being undertaken and there will therefore be pockets of IPTV-positive infrastructure, where the technology will thrive. However, in general, broadband penetration in the region remains low. IPTV is therefore restricted from even greater progress, both by this lack of broadband penetration and also by the fact that where broadband is in place it is not always suitably robust to facilitate IPTV provision.

There are also other fundamental issues to address, like how to get the sector to be run on a fully commercial basis. Much-needed consolidation amongst the main pay TV platforms has finally taken place, resulting in the creation of OSN. It has added some attractive premium content to its roster, but the most significant omission from its line-up is the most sought after sports content, particularly soccer. According to Thomas: "Most of the top soccer rights have been snapped up by the state-backed operators, who have the financial muscle to outbid OSN, even if the business case for doing so is not there. For them a return on investment is a desirable rather than essential outcome, putting the likes of OSN on the back foot in content auctions."