What South African consumers want from retailers in 2023

Using a unique blend of AI and human intelligence, DataEQ has sifted through millions of social media mentions relevant to the South African retail sector to identify the top three trends emerging in 2023.

1. E-commerce expectations are on the rise

The development - and widespread use - of e-commerce facilities has already impacted the infrastructure of many retail businesses. Not only do retailers need to develop the technology and systems required to get goods delivered timeously, but they also need to satisfy escalating customer experience demands. It’s a double-edged sword where improved customer experiences drive higher expectations, with the one feeding off the other.

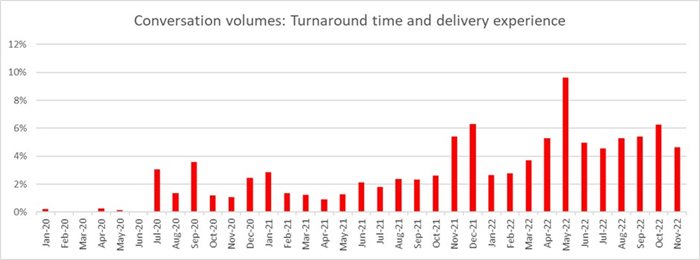

The following chart showcases the gradual uptick in consumer conversation related to turnaround time and delivery experience from January 2020 to 31 Oct 2022.

As consumers come to expect an increasingly seamless digital experience, retailers must ensure that their communication strategy is robust and that digital service teams are equipped to handle large volumes of requests in near real-time.

Consumers expect retailers to have brand agents available around-the-clock to tackle service requests not only through call centres, but on social platforms too. Response rates and times are important for brand agents, but they also need to be equipped with the necessary operational understanding and soft skills to navigate instant messaging, as well as be able to escalate tickets effectively and correctly.

2. Sustainability is more than just a nice-to-have

As environmental, social and governance (ESG) factors continue to have a growing impact on consumers’ decision-making, retailers are becoming more transparent about their sustainability strategies. Although this is an emerging theme and remains more prevalent for retailers catering towards higher Living Standard Measure (LSM) groups, it could have a potentially significant impact on brand loyalty, as savvy consumers seek to compare sustainability practices across retailers.

Consumers are also becoming more sensitive to greenwashing, demanding real action be taken by retailers to increase sustainability. The following chart, which shows the Net Sentiment* and volume of conversations comparing local and imported goods, reveals increased conversation volumes over the last two years, along with a sharp drop in sentiment. This indicates that consumers are becoming more sensitive to the carbon footprint of products stocked on shelves.

3. Special offers remain key to South Africa’s wallets

Affordability no longer governs consumer preferences in South Africa. This is exhibited in the following graph, which shows how consumers are speaking less about price and more about promoted specials.

South Africans want to feel like they’re saving when using a premium service, and well-executed specials are key to achieving this. With the continued growth in e-commerce facilities, retailers need to focus their efforts on controlling the narrative around price to allure consumers to shop with them.

For local businesses operating in the retail sector, getting ahead of these emerging trends can not only help improve customer experience, but also add some strategic direction in an otherwise unpredictable landscape.

* Net Sentiment is an aggregated customer satisfaction metric that is calculated by subtracting negative sentiment from positive sentiment. Net Sentiment is typically reflected as a percentage.

About Shannon Temple

View my profile and articles...