Draft legislation and proposed advanced pricing agreement programme model published

The South African Revenue Service (Sars) has published draft legislation and a proposed model for establishing an advanced pricing agreement (APA) programme in South Africa. The development of an advanced pricing model was recommended by the Davis Tax Committee and is in line with the creation of a world class tax facility that will provide clarity and certainty for taxpayers. The aim of such a model is to make it easier for taxpayers to comply with their obligations in South Africa, while also building confidence in the tax administration system.

An advanced pricing programme is defined by Sars as “an agreement for a defined period of time between an applicant, the competent authority of South Africa and the competent authority of another country, which has an agreement for the avoidance of double taxation with South Africa, regarding the advance pricing arrangement of an affected transaction between and among associated enterprises and connected persons in relation to the applicant.”

The APA is relevant to multinational organisations operating in South Africa and to which the South Africa transfer pricing provisions apply. It effectively provides them with greater certainty for a defined period regarding the transfer pricing methods they apply. It does so by ensuring they have a robust discussion with Sars prior to implementing the policies, thereby reducing their exposure to time-consuming and expensive audits and disputes.

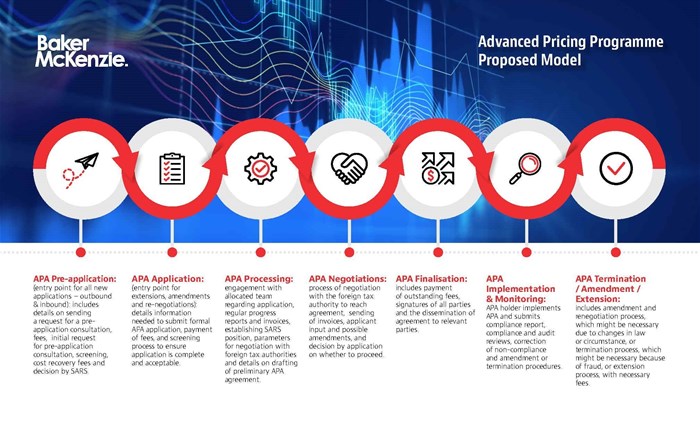

The Proposed Advanced Pricing Programme Model

According to the draft legislation, the model has seven sections, details of which follow below:

- The first section details the APA pre-application process. This process includes details on sending a request for a pre-application consultation, the fees for doing so, the initial request for a pre-application consultation, screening, cost recovery fees and the decision by Sars.

- The second section comprises information needed to submit a formal APA application, payment of fees, and the screening process to ensure the application is complete and acceptable.

- The third section is the processing phase, during which a case will be allocated to a team for examination and analysis. Engagement regarding the application, regular progress reports and invoices, establishing of the Sars position, parameters for negotiation with foreign tax authorities and details around the drafting of a preliminary APA agreement are included in this section.

- The fourth section details the process of negotiation with the foreign tax authority in order to reach agreement, the sending of invoices, applicant input and possible amendments, as well as a decision by the application on whether to proceed.

- The fifth section is the finalisation stage, which includes payment of outstanding fees, signatures of all parties and the dissemination of the agreement to relevant parties.

- The sixth section involves implementation and monitoring, wherein the APA holder implements the APA and submits the compliance report, as well as compliance and audit reviews, the correction of non-compliance and amendment or termination procedures.

- The seventh section includes termination/amendment/extension procedures, which include the amendment and renegotiation process, which might be necessary due to changes in law or circumstance, or the termination process, which might be necessary because of fraud, misrepresentation or non-compliance, for example, or an extension process, with the necessary fees

According to Sars, the APA programme will be administered by way of notices in the Government Gazette, including the publishing of the parameters for the agreements, which parties are eligible to enter into an agreement, the quantum of relevant fees, the minimum value of the transactions that qualify and the procedures and guidelines for implementation.

Potential challenges regarding the implementation of the model include the lack of transfer pricing skills in the country, which will require time to acquire and develop. The suggestion has been to exchange personnel between the new APA unit and the existing Transfer Pricing in the early days of development.

Once the legislative framework is in place, a pilot project will be implemented that will accept bilateral applications, allowing time for personnel to learn from other jurisdictions and for capacity development to take place before the full programme, that includes multilateral applications, is introduced. Further feedback on the proposed APA model will be incorporated into the draft legislation.

Taxpayer considerations

Taxpayers to whom the APA programme will apply are encouraged to engage with their advisors and consider the following:

- The nature of the transactions to be undertaken and whether these are straightforward or complex and therefore requiring certainty.

- Whether the transactions to be covered would remain relatively the same or if they will vary.

- The possibility of future transactions which may result in queries.

- The cost and time to prepare the requisite transfer pricing documentation and whether an APA would reduce this.

- The reputational risks associated with a dispute with Sars.

- The impact of the Organization for Economic Co-operation and Development’s Pillar 1 and Pillar 2 on their business and whether an APA would be beneficial in this regard.

About the author

Denny Da Silva is an Associate Director in the Tax Practice of Baker McKenzie Johannesburg.