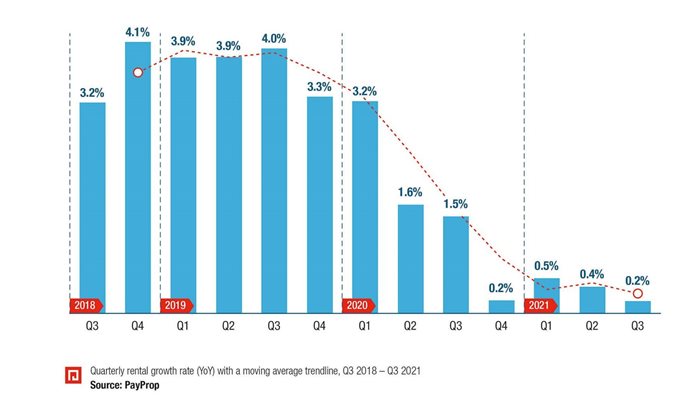

Q3 2021 PayProp Rental Index: Tenants continue to feel pinch of pandemic

Johette Smuts, head of data analytics at PayProp, says tenant affordability continues to put downward pressure on rental prices. “Unemployment is at an all-time high in South Africa, framed by an economy that is slow to improve. Tenants continue to feel the pinch of the pandemic, specifically in light of a predicted fourth wave.”

Provincial outlook

Mpumalanga is the only province to experience positive year-on-year rental growth in each of the past four quarters. It also experienced the fastest rental growth of any province in the most recent quarter. In Q3, average rents increased by 3.5%, up R257 from R7,442 to R7,699. Rent is just R101 cheaper in this province than the national average of R7,800.

The Western Cape boasts the second-highest rental growth after Mpumalanga, at 2.5% year on year over the quarter. Before the 1.8% increase seen in Q2 2021, the province had experienced four consecutive quarters of negative rental growth. Average rent increased from R9,041 a year ago to R9,266 in the most recent quarter. It is still the most expensive province in which to rent.

Gauteng recorded its second consecutive quarter of negative rental growth with a decrease of 2.3% – the second worst performance out of all provinces. The quarter before, rent decreased by 0.6% year on year, after two quarters in which rent increased by 0.7% each time. The average rent in Q3 was down to R8,235 from R8,432 a year before.

Rental growth in KwaZulu-Natal bounced back in Q2 and Q3 this year after two quarters of declining rent. The average rent increased 1.3% year on year in the most recent quarter, bringing this figure to R8,232, up from R8,123 the year before. If the rebound continues, KwaZulu-Natal could overtake Gauteng to have the second highest rents in South Africa next quarter.

Improving arrears

According to index data, the percentage of residential rental tenants in arrears has declined steadily since it peaked in Q2 of 2020. In fact, in the most recent quarter, percentage arrears had decreased to 19.1%, a figure that’s lower than pre-lockdown numbers.

Smuts says the average size of individual arrears has also been declining each quarter, since its peak in Q3 2020. “In Q1 last year, tenants in arrears owed on average 78.5% of one month’s rent. That increased to 96.3% in Q2 (the first quarter in lockdown) and further to 104.6% in Q3. For this metric to decrease, tenants in arrears have had to pay their full rent plus an additional amount towards their debt each month – not an easy feat in the current economic climate.”

In the most recent quarter, tenants in arrears owed on average 82.3% of one month’s rent – still slightly above the 78.5% seen before the pandemic. However, the improvement in this metric over the past year is very encouraging.

Smuts says that while the outlook remains less positive than in previous years, only two out of the nine provinces saw average rent levels decline this quarter. This is in comparison to four a year ago, and five in the last quarter of 2020.

Download the full PayProp Rental Index here.