The 'foreign' impact on South Africa's potato industry

Insight Survey's latest Carbohydrate Landscape Report comprises extensive primary research (including in-depth interviews with leading industry experts) in order to ascertain and provide detailed insight into the current impact of the 'foreign' on domestic market dynamics.

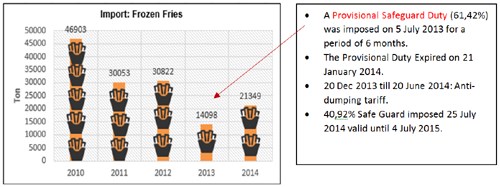

The local industry has been waging a bitter war against foreign imports, after frozen French fry imports increased by 400%, severely affecting domestic fast-food and consumer markets. In the following example from our report, we trace the trend in importation and the associated effects of local Governmental intervention

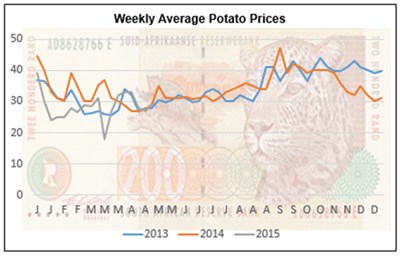

What this equated to at the end of 2013 was a positive effect on local market prices due to reduced importation; however with the increase in imports in 2014, this has once again had a negative effect on local market prices and the entire value chain in general.

During one of our interviews with Potatoes SA they confirmed this, stating that "Frozen French fry imports increase the potential volatility of the South African potato market. The dumping of oversupply into the local market leads to unforeseen pressure on the marketing channels available for producers and other role players within the potato value chain".

A further concern has been the recent increase in potato plant infection with foreign bodies, which has led to considerable losses to domestic yields. During our interview with Rudolf Badenhorst, Head of Market Development at Potatoes SA, he reiterated that "Potatoes are susceptible to a variety of viruses and pests that can influence the quality of the harvest'', however indicated that future yields should improve as ''Cultivars are being developed that are less susceptible to pests and viruses and that yield more per hectare that older varieties".

Lastly, the fiscal effects of the xenophobic riots have been felt across the agricultural sector. It is estimated that the informal sector buys more than 50% of potatoes from fresh produce traders, markets that have, in certain areas, come under severe pressure due to unrest.

As the statistics indicate, the large price dip in March coincided with the xenophobic riots, and prices were much lower than the same time in 2014. However, whilst the riots continued into April, the prices recovered dramatically. Thus it appears that the effects of the riots were felt predominantly during March, and not April. This was stressed by Potatoes SA who stated that ''Given the price trends observed during April no conclusive evidence exists to indicate that xenophobia impacted negatively on prices in April, especially in the light [of the fact] that record volumes of potatoes were sold on markets during April''.

The Carbohydrate Landscape Report (124 pages) provides a dynamic synthesis of primary and secondary research, including extensive interviews with relevant stakeholders and industry experts across the value chain: from organisational bodies to manufacturers, retailers and leading academics.

Some Key Questions The Report Will Help You To Answer:

- What are the key factors that are restraining and driving the growth of the local and global markets?

- What are the local and global supply and production trends and predictions?

- What are the local and global demand and consumption trends and predictions?

- What were the Manufacturing and Retail sectors' overall financial performances for 2014?

- What are the consumption trends in the following carbohydrate sectors: rice; pasta; mealie meal; bread; potato chips; breakfast cereal; frozen potato products?

Please note that the 124-page PowerPoint report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 830-5638.

For a full brochure please go to: http://www.insightsurvey.co.za/2015-carb-landscape-report

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business's competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za. Alternatively, contact Yashvir Maharaj on +27 (0)21 045 0202.

- How are mobile platforms and the metaverse driving SA’s long-term insurance industry growth? 6 Mar 2024

- Multi-strain products supporting South Africa’s probiotics market culture 22 Nov 2023

- Bridging the gap: Embedded insurance trending in SA's short-term insurance industry 15 Nov 2023

- Sustainable packaging pumps South Africa's bottled water industry 4 Oct 2023

- Specialised diet pet foods trending in the South African market 27 Sep 2023

Insight SurveyInsight Survey is a South African B2B market research company with almost 15 years of experience. We specialise in telephone interviews, online surveys, industry analysis and competitive intelligence to help improve or grow your business. |