End-of-year essential read: Look back at the best (and worst) of 2022 to flourish in 2023

In his 2019 State of the Nation Address, President Ramaphosa specified: “Our greatest challenge is to create jobs for the unemployed of today, while preparing workers for the jobs of tomorrow.” A noble target until the world turned on its head, and Africa’s most industrialised nation claimed one of the highest unemployment rates in the world.

So, while it may provide constant fodder for memes, life in South Africa is no joke. In 2022, some of the top listed struggles from our Consumer Issues Barometer ranged from potholes to the constant loadshedding struggle, water woes and the rising pricing on everything.

While some jokingly suggest adding ‘living in ZA’ to their skills listed on LinkedIn, many have seemingly thrived on this frantic ‘must earn more and do more with less cash’ mindset that drove purchase behaviour in 2022. Higher prices across the ‘good things in life’ – petrol, entertainment and basic living staples of food and drink – saw many choose to stay home, even after the heaviest Covid-19 restrictions were lifted.

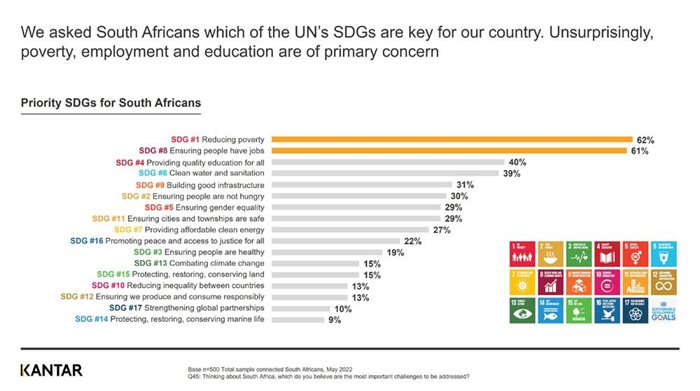

Because there’s a prevailing sense that life is harder, if not more expensive, than before. Alongside our South African Consumer Issues Barometer*, Kantar has tracked consumer issues globally, and of the 18 markets surveyed, South Africa has the most negative general economic outlook based on households’ present financial situation. So, while the highest concern globally is war, followed by education, the economy and health, SA’s near the top of the charts on economic concerns, which translate as unemployment, electricity, and the cost of living, with corruption, crime and violence also top of mind.

The cost-of-living crisis has heavily impacted life plans in South Africa, especially for the 4 in 10 households now earning less than before the pandemic. Lower-income homes have obviously been the hardest hit by the 9% increase across FMCG goods over the past year – Kantar’s Worldpanel reveals that the cost of cooking oil alone has risen by 36%.

Not only are we saving less with more dependents to support, but around a quarter of respondents have also adjusted plans to move house or retire; 17% have changed plans to emigrate or ‘semigrate’ to another part of the country; and similar figures putting off plans to start a family or get married. Despite this, optimism around a favourable future financial position is high, particularly amongst higher-income homes, where almost half believe they will be better off financially in a year’s time.

The new mantra of digital life in South Africa: Search, social and streaming

With 35% of lower income households actively looking for work, those already employed feel increased flexibility on where they work. Despite 63% of companies having assisted with work from home set-ups, 36% of South Africans are back to facing the office commute for the full work week with just 13% going fully remote and the rest juggling a hybrid/flexible model.

Once we log out of work mode we therefore laugh, cry, press pause to get more popcorn, and spend more time online looking for tips to better carve out home-life balance in the new world of work. Healthy recipes, home workout and how to apply eyeliner trended on search, social and video streaming platforms locally.

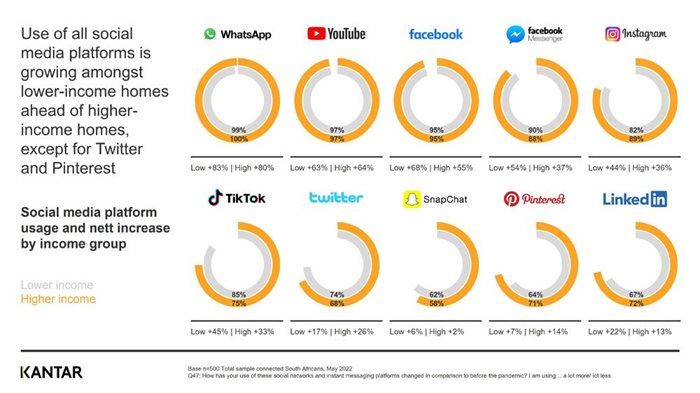

WhatsApp, YouTube, and Facebook are the top three growth platforms of the past two years with every single connected South African using WhatsApp and just 1 in 5 not active on Instagram. Brands, are you listening?

This influences South African shopping behaviour and ecommerce, with top terms ranging from ‘supporting local’ while also looking for better value beyond price to what’s in it for me, in everything from shorter delivery time to double-up deals and loyalty points.

There’s also a high price attached to taking a risk in trying something new. Some premium brand consumers are willing to pay for risk reduction, with our 2022 Inflation and Risk Reduction study showing people evaluate the prospect of gains differently than the prospect of losses. Bad events affect people more profoundly than good events, so people will opt for the certainty of smaller gains over the uncertainty of potentially larger gains.

The brand imperative is therefore to remove the risk. But remember value-building opportunities are left on the table when defaulting to discounting under the assumption that trading down is the only option.

Non-cash, non-new: Circular economy in the spotlight

Interest in second-hand purchases and the circular economy has grown, driven by platforms such as Gumtree and Facebook Marketplace. Digital devices, women’s fashion and home appliances fall under the top global categories while in South Africa, 78% now buy second-hand products, either online or offline.

This year has also seen a marked shift in payment, with non-cash options like credit card, debit card and mobile app now the payment norm for 92% – a 32% nett increase among connected South Africans. This facilitates online shopping across income groups, especially for households’ RGD or Rapid Grocery Delivery and fast-food takeaway orders, much of which started under lockdown and has continued due to the sheer convenience factor as the experience has largely improved since the early days of out-of-stocks and extended delivery time. Read more about Kantar’s eCommerce ON 2022 trends study.

Sustainable sustainability to better society, immediate environment, and the wider world

Despite the online focus, South Africans are also aware of their offline impact on the planet. Because for the first time in history, sustainability issues are seen to pose the greatest risk to the world. There’s new understanding of the importance of sustainability and being part of the solution as businesses increasingly aim for profit with purpose. South Africans want to go beyond clicktivism and actively move the needle on the climate emergency. It’s no longer something happening ‘somewhere else’.

Unfortunately, the challenge is that it often feels like a trade-off of sustainability against price and effort, as 62% of South African consumers find it difficult to be more environmentally friendly because products that are better for the environment are harder to find or more expensive.

Our 2022 Kantar BrandZ Most Valuable Global and South African Brands reports both speak to the importance of helping carve this journey, as brands with strong corporate reputation grow in brand value 40% faster, with responsibility 300% more important today than it was a decade ago in driving corporate reputation.

So, brands need to focus on where you have a ‘right to play’ in the eyes of consumers, rather than being purely internally or operationally focused. What sustainability issues are relevant to consumers in your category for your brand? What issues will consumers trust your brand to authentically take on? How do you put sustainability at the heart of your innovation process?

With 2023 on the horizon, brand-building basics remain the same: marketers’ key role is to find ways to meet consumer needs without trading out the hard work building your equity.

Brand differentiation helps shift from the functional physical provision of the product to find the experience- or emotion-based differences that justify paying the price asked above your competitors. Once you understand the consumer tension and the benefits that drive value, you can better drive differentiation through meaningful innovation. But what will this look like in 2023?

Positive outlook ahead: Your three-pronged 2023 starter pack

If 2022 has proven anything, it’s that South Africans are ready for whatever comes next. They’ve battled endless waves of pandemic, inflation, and risk, bolstered by resilience and optimism that brighter days are around the corner. Brands can bottle that sunshine in three ways:

- When it comes to e-commerce, think ‘price plus’. As adoption and momentum keeps growing for all things online, avoid price wars by paying attention to the value shoppers are seeking, as well as their priorities and trade-offs they’re willing to make.

- Build this further by reminding consumers of the benefit of your brand. Also use meaningful innovation to drive perceptions of difference and justify the price. Read more about the five principles that will transform your innovation development journey from successful food and beverage innovators.

- Your sustainability strategy starts with the consumer. Streamlining internal business processes to be more environmentally friendly is now largely expected, so won’t result in compounded ‘goodwill equity’. Drive brand desire and perceptions of difference by solving for consumer expectations within the context of where the brand has a right to play.

That’s a wrap. May fortune ever be in your favour amidst all the challenge, and may you never lose sight of the opportunity. Unpack the top trends predicted to impact your industry in the coming months with our Media Trends and Predictions 2023 report and join the conversation on LinkedIn or Twitter to keep up to date with our comms. Wishing you and your team all the very best for the year ahead.

*Our Consumer Issues Barometer offers an evaluation of these changes over the past few years among South Africa’s connected population, which represents 72% of the country and skews younger, with 60% under age 34, across the full income spectrum. Find out what marketers need to know now.

- Diary of a CMO: How can I protect my brand against copycats? 18 Feb 2025

- What makes or breaks a product launch? 11 Feb 2025

- GenAI in marketing: Fear or FOMO? 30 Jan 2025

- Diary of a CMO: Is your category’s ceiling coming down on you? 28 Jan 2025

- 3 questions to identify your brand’s strategic priorities for 2025 5 Dec 2024

KantarKantar is the world's leading evidence-based insights and consulting company. We have a complete, unique and rounded understanding of how people think, feel and act; globally and locally in over 90 markets. By combining the deep expertise of our people, our data resources and benchmarks, our innovative analytics and technology we help our clients understand people and inspire growth. |