How ESG and social investment trends will affect the future of CSI in South Africa

On 24 February 2022, responsible business consultancy Trialogue hosted a webinar that explored how global companies are engaging with these issues – which include human rights, racial and gender diversity and environmental stewardship, among others – and how different approaches to ESG and social investment are likely to affect the future of corporate social investment (CSI) in South Africa.

The panellists were Beth Gallagher, director of corporate insights at US-based Chief Executives for Corporate Purpose (CECP), Rohan Sarma, knowledge and research head at India-based Samhita Social Ventures, and Trialogue director Cathy Duff.

The webinar began with a snap poll to find out from attendees when they thought it likely that ESG would be integrated across every department within their organisation. Just over half (51%) said this would take place within the next two to five years, with 26% indicating they expected full integration within the next year. These results are in line with global findings that more than three-quarters of companies believe that ESG will be integrated across every department in their company within the next five years. This suggests that the Covid-19 pandemic has helped to entrench ESG thinking on a strategic level in companies.

A global overview of ESG and social investment

Beth Gallagher presented findings from CECP’s Global Impact at Scale 2021 Edition, which was released in January 2022. This comprehensive report, which brings together insights from 165 companies in 18 countries and regions, examines trends in ESG management, integration and reporting, as well as employee engagement insights and Covid-19 responses, among others.

According to Gallagher, the report underscores how human and economic challenges that arose during the pandemic, such as climate-related disasters and racial justice issues, had a significant if varied impact on companies. A key insight is that the deepening needs of global communities, as well as changing stakeholder expectations, have driven momentum around advancing ESG.

The survey found that community spend increased dramatically during 2020 – CECP’s report noted a 77% increase in median community spend, from $2.8m in 2019 to $4.9 million in 2020. Although some sectors experienced declining revenue, most companies responded to unprecedented need, with 65% of new interventions focusing on healthcare.

While this was encouraging news, there was less to celebrate regarding Diversity, Equity and Inclusion (DEI) as workforce representation over a three-year period showed incremental gains only – a 1% increase of women in the workforce, and a 1% increase of minorities in management positions, for example. However, Gallagher pointed out that the pandemic and the murder of George Floyd have changed views about systemic racism in the US.

“Instead of DEI efforts being managed by a diversity leader, we have seen it becoming everyone’s job, in an authentic and fundamental way, which has been heartening,” she said. “Around 70% of companies are investing in DEI and we will watch to see what comes out of these programmes.” A company performing well in this area is the retailer Target, which has pledged to increase the number of Black employees by 20% by 2023, and plans to spend $2bn with Black-owned businesses by 2025.

“Corporate leaders need to lean in, listen, humble themselves, and respond to these issues in a different way,” Gallagher advised.

Insights from India

India experienced upheaval during the pandemic. “Covid-19 tested the resilience of institutions, values and systems,” Rohan Sharma commented. “It really exposed the myopic approach of several Indian businesses, along with their ESG vulnerabilities.”

A notable concern is the fact that women were hardest hit during the pandemic – and female participation in the workplace is significantly lower in India compared to the global average. Samhita’s Women@Work alliance – a coalition of businesses, philanthropies, social organisations and other stakeholders – aims to address this challenge.

Ironically, however, there has been a silver lining to the pandemic. “Had Covid-19 not come along, overwhelming ESG buy-in would not have occurred,” Sarma pointed out.

For Sarma, ESG is far more than a tool that makes for better non-financial reporting. Used strategically, ESG principles help companies to become “neighbours of choice” – good corporate citizens and environmental stewards. “ESG helps to create shared prosperity through shared values,” he said, adding that his personal definition of ESG focuses on key concepts that define a holistic vision of business in society: ‘Ethics/Equity, Social contract/Supply chain management, Good/Greed’.

“The ethical approach to making profit is a paradigm shift, since profit has always been considered a dirty word,” he explained. “Development problems are complex, however, and increased interconnectedness allows us to collaborate to solve them.”

He named Indian multinationals and companies that exemplify good corporate citizenship, like the Tata Group, Reliance Industries, Ashok Leyland and Infosys, among others.

He also drew attention to insights that emerged from the pandemic, namely: once-off corporate philanthropy does not work; participatory, qualitative surveys are preferable to quantitative surveys as they can better meet the needs of vulnerable communities; and communities should not be the passive recipients of grants – instead, they should be empowered by rights-based legislation.

With this last point in mind, Samhita has developed a Multidimensional Community Empowerment Index, which will measure the extent to which communities have been empowered. This is seen as complementary to ESG reporting.

Lessons for South Africa

The global trends offer some pointers – and lessons – for South Africa. The country is tracking the global experience of ESG adoption – 67% of South African companies surveyed by Trialogue in 2021 are already integrating ESG into their business strategy. What this means is that we are likely to see more aligned and strategic social investment, according to Cathy Duff. This may mean more non-cash giving in future, and we can expect to see companies investing in larger, longer-term programmes.

Although NPOs may have fewer corporate partners, these partners could well offer more meaningful support, especially if NPOs use the skills, resources, and services of the company. This could be a positive development, especially as social investment is expected to increase in the coming years. NPOs should develop structured volunteering opportunities for their corporate partners, as employee engagement is another increasingly important area for companies, with most large companies now offering employee volunteering programmes, and these expected to become more strategic.

Duff said that the International Sustainability Standards Board had been formed in November 2021 to create a global standard around ESG disclosure requirements. “Disclosure around standardised metrics will be expected, and there will be a move towards impact metrics, not just inputs and risks to investments,” she said. This means that CSI practitioners and NPOs will have to measure and report on impact, and such reporting is likely to be linked to the targets and indicators of the sustainable development goals (SDGs).

Climate will become a key priority, Duff said, as companies commit to Net Zero targets. “Companies will have to plan how to reach Net Zero – not just in terms of mitigation and avoiding emissions, but building resilience in supply chains and communities, and making adaptations,” she asserted. Social investment programmes will need to articulate the impact they have on the environment and demonstrate how they contribute to Net Zero goals.

Currently, only around 18% of South African companies invest in environmentally-focused CSI projects, and around a quarter do not consider the environment at all in their CSI programmes. “This should shift in the coming years as the environment becomes a global priority,” Duff pointed out.

Advice for corporates

Gallagher said corporate leaders need to prioritise employee engagement. “Employees are stakeholder number one now,” she said. “If leaders can’t demonstrate that they’re leading with purpose or behaving in ethical ways, they’ll fail to attract, retain and engage the talent they need to meet the needs of today.”

Sarma asserted that companies need to embrace and accept a “better normal”, particularly when it comes to community inclusion. “Companies need to move from adopting communities to becoming service providers and neighbours of choice,” he proposed. “The idea is not to empower people one by one, but to facilitate and create an equal system that expands the capabilities and capacities of people so they can empower themselves.” (See Sarma’s ten-point plan for corporates below.)

Duff’s final word of advice to company leaders is that economic and regulatory pressures, together with pressure from stakeholders, will make change unavoidable, but there is opportunity in change for companies to achieve real impact and sustainability.

Further resources

- Trialogue’s primary research has been published in the Trialogue Business in Society Handbook 2021. Download a free copy here: https://trialogue.co.za/publications/

- CECP’s Global Impact at Scale 2021 Edition report can be downloaded here: https://bit.ly/3M0LYKL

- Read more about the Women@Work alliance here: https://bit.ly/36Gb4hT

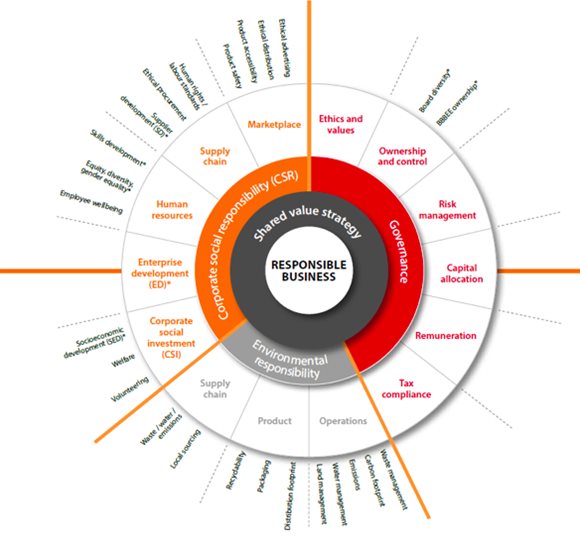

- Responsible business concepts ecosystem – Trialogue’s definitions framework

Rohan Sarma’s ten-point plan for corporates wishing to adopt an ESG agenda is as follows:

- Corporates must accept the new reality of a ‘Better Normal’ (the tagline of Samhita), since time is running out with respect to global warming and environmental and social risks.

- Companies should consider constituting dedicated ESG board committees, in line with greater focus on corporate governance – a trend led by the Ministry of Corporate Affairs and the Securities and Exchange Board of India.

- ESG investing is an ethical approach to profit-making. Ethics, equity and circularity should therefore be central principles of ESG.

- We need to invert ‘CSR’ to ‘RSC’ and change the discourse from mere Corporate Social Responsibility (CSR) to Resilient Supply Chains (RSC) if we are to go beyond corporate responsibility and make a case for corporate accountability. This will fill the gap in CSR discourse, which limits itself to responsibility only, which is too selective.

- Companies need to increase investments in innovation and research as well as knowledge partnerships. Samhita is driving this agenda along with several corporate partners, and has developed innovative products in the social sector in India like the Returnable Grant and the Multidimensional Community Empowerment Index (MCEI).

- Companies should create a framework for supporting innovation through building a start-up ecosystem where ideas and solutions can be incubated for scaling up. By doing this, companies create more entrepreneurs who are in turn able to generate more employment opportunities through their ventures.

- Diversity and Inclusion needs to become a serious agenda in workplaces where positive discrimination and social justice principles drive recruitment policies and practices.

- Companies need to adopt more participatory approaches and realise that investing in communities they work around is a strategic business choice, rather than a mere corporate philanthropic obligation. They must be cognizant at all times that their license to operate is dependent on the community and that business cannot be sustainable against the backdrop of a trust deficit or hostility with communities in which they operate. Therefore, through CSR and ESG commitments, corporates need to transition from becoming ‘neighbours by forceful acquisition’ to becoming ‘neighbours of choice’ for communities.

- Drawing from the 'Capabilities Approach' of Nobel Laureate Dr Amartya Sen, the Multidimensional Community Empowerment Index (MCEI) tool developed by Samhita seeks to hold the hand of corporates in addressing community issues more effectively and gauging community impact more precisely. Corporates can contribute to community empowerment through creating an ecosystem that expands the capacities and capabilities of institutions and systems. This facilitates individual self-empowerment.

- While there is a lack of a global framework for reporting, measurement and transparent disclosure of corporations, India has taken the lead by creating a Business Responsibility and Sustainability Report template in 2020 and by becoming the first country in the world in which BRSR has been mandated by the market regulator Securities and Exchange Board of India for the top 1 000 listed companies. Such valuable tools help business to communicate their ESG commitments.

- New Trialogue research reveals leaders in corporate giving 4 Dec 2024

- FirstRand Empowerment Foundation shares agri vision at Trialogue Business in Society Conference 2 Sep 2024

- Beyond Mandela Day: the power of employee volunteering programmes 16 Jul 2024

- Enabling intergenerational inclusion in entrepreneurship 9 Jul 2024

- Future-ready youth – Business must collaborate to build skills for the evolving workplace 1 Jul 2024

TrialogueTrialogue is one of only a few consultancies in South Africa that focus exclusively on corporate responsibility issues. Over 25 years of experience puts us at the forefront of new developments in sustainability and corporate social investment (CSI). |