SA invests R10.7bn in corporate social investment during 2020

Trialogue director Cathy Duff said: “CSI expenditure in real terms has not shown a consistent trend since a period of growth between 1998 and 2013. Although we see a slight increase in 2020, we expect that as the economy contracts, so too will CSI expenditure, which generally lags GDP growth.”

CSI expenditure remained concentrated, said Duff. The top 100 companies (by CSI spend) accounted for 69%, or R7.4bn, of total CSI expenditure. Of this R7.4bn, almost two-thirds was spent by the 20 companies whose CSI expenditure was more than R100m in 2020.

Companies that donated the most operated in basic resources (mining, water and forestry), retail – boosted by product donations ‒ and financial services. Together, these three sectors accounted for nearly two-thirds of CSI spend. Non-cash giving (products, services, time) constituted 16% of total CSI allocation.

Response to Covid-19

Almost all companies focused on the health and safety of their staff (99%) and customers (83%) in their response to Covid-19. Fewer (40%) offered support to suppliers.

At least four out of five companies donated to Covid-19-specific responses, with most supporting interventions in food security (64%), healthcare (60%), and in the form of contributions to the Solidarity Fund (60%). Two-thirds took part in multi-stakeholder responses such as government dialogues and industry initiatives.

The reported impact of Covid-19 on CSI spend was mixed. Almost equal numbers of companies reported increased expenditure (26%), no change in expenditure (21%) or reduced expenditure (21%). Several companies (13%) reported that expenditure remained the same but was redirected to respond to Covid-19. Only 4% of companies ceased or put all CSI funding on hold.

Causes and geographies supported

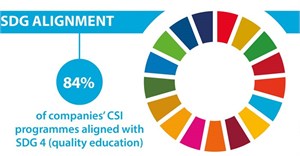

As in previous years, education was the most popular cause, supported by 95% of companies and receiving half of all CSI expenditure, said Duff. Social and community development remained the second most supported sector, followed by health, then food security and agriculture. Disaster relief received a relatively small percentage of CSI spend, but many more companies contributed to it this year.

“Corporates supported projects across an average 4.6 sectors, broadly consistent with previous years. This figure is significantly higher than United States companies, which are more focused and supported projects in an average 1.4 sectors in 2017.”

Over half of CSI spend (54%) was allocated to projects with a national footprint. Gauteng was the most supported province in 2020 (48% of companies directed funding to operations in the province which received on average 19% of companies’ CSI expenditure). This was followed by KwaZulu-Natal (supported by 35% of companies) and the Western Cape (supported by 28% of companies).

Funding recipients

In line with previous years, non-profit organisations (NPOs) were the main recipients of CSI funding. Over 90% of companies directed an average 54% of their spend to NPOs.

The next most common recipients were government institutions such as universities, schools, clinics and hospitals. These were funded by 69% of corporates and received on average 25% of companies’ CSI spend.

One out of five companies funded social enterprises, which aim to maximise profits while maximising benefits to society and the environment. This, however, amounted to only a small percentage (2%) of average company CSI spend.

Rationale and strategy

“The majority of companies (81%) rated ‘moral imperative’ as one of their top three reasons for supporting CSI, with 53% rating it as the top reason. This is consistent with previous years,” said Duff.

More than half of companies undertook CSI because of licence-to-operate obligations other than B-BBEE, although only 11% ranked this as their top reason.

Reputational benefits, which ranked second in 2017, were rated lower this year. Only 35% of companies reported reputational benefits as one of their top three reasons for supporting CSI.

Impact of weak economy

Discussing trends in local CSI, Duff noted that net profit after tax (NPAT) of the 194 listed companies analysed showed a median decline of 12.7% in 2020, reflecting the weak state of the economy.

“CSI budgets are often determined as a percentage of NPAT and are based on the financial performance of the previous year. This results in a lag between current NPAT performance and budgeted CSI spend.

“Declining corporate profitability is expected to have a negative impact on future CSI budgets, although the extraordinary contributions to Covid-19 relief programmes in 2020/21 may delay the downturn in CSI spending.”

Click here to download the free online version of the handbook.