Repo rate remains unchanged at 3.5%

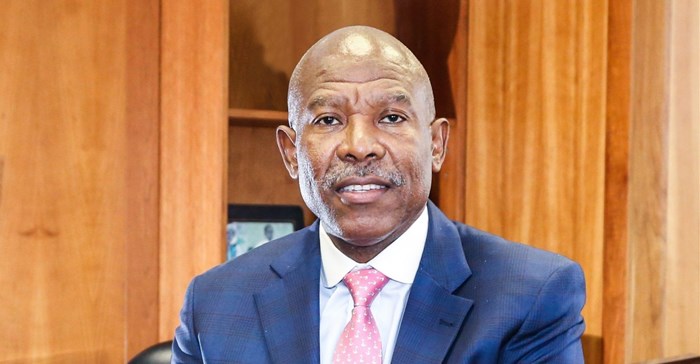

Sarb Governor Lesetja Kganyago made the announcement on Thursday, following a Monetary Policy Committee (MPC) meeting. The committee expects economic and financial conditions to remain volatile for the foreseeable future. “In this highly uncertain environment, policy decisions will continue to be data dependent and sensitive to the balance of risks to the outlook."

This is the second time the Sarb has not decreased the repo rate since the advent of Covid-19 in the country in March. In that month, the MPC cut rate by 100 basis. A second 100 basis points cut was announced in April. This was followed by two 25 basis point decrease in May and a further 25 basis point cut in July.

Kganyago said the monetary policy has eased financial conditions and improved the resilience of households and firms to the economic implications of Covid-19 and continues to be accommodative.

“The bank has taken important steps to ensure adequate liquidity in domestic markets. Regulatory capital relief has also been provided, sustaining lending by financial institutions to households and firms,” he said.

Commentary

In response to the unchanged repo rate, Luigi Marinus, portfolio manager at PPS Investments said the Sarb moderated their expectation of GDP growth for 2020 from -8.2% to -8.0%, and GDP growth is now expected to increase by 3.5% in 2021 and 2.4% in 2022. This is notably lower than global GDP growth expectations of a 4.4% decline in 2020 and an increase of 5.2% in 2021 according to the latest International Monetary Fund (IMF) forecasts.

"Inflation expectations by the MPC remains muted, with a forecasted average of 3.2% for 2020, 3.9% for 2021 and 4.4% in 2022. The MPC has acted assertively since the start of the lockdown by reducing the repo rate to the current level of 3.5%. However, with the current available economic statistics, it is difficult to see why this has stopped. South African GDP growth is expected to disappoint relative to global levels and inflation is expected to remain below the midpoint of the target band over the next two years. While monetary policy alone cannot reverse the difficulties many South Africans are facing, any further reduction to short term rates will have a stimulatory effect to the economy," he said.

Sanisha Packirisamy, economist at Momentum Investments said: "We suspect the Sarb is at the end of its interest rate cutting cycle. A dismal growth trajectory and depressed demand exerts downward pressure on inflation in the near term. However, the Sarb noted risks to longer term inflation expectations remain broadly balanced. In addition, the Sarb reiterated its concerns over the country’s fiscal and debt burden. We are of the view that additional easing is less likely from here, unless SA suffers another growth setback induced by a renewed country-wide tightening in lockdown restrictions or if there is another sharp dip in inflation. We expect the Sarb to consider interest rate hikes from the second half of 2021."

While there has been no change, it is important to consider that we started 2020 with the prime lending rate at 10%. Although there has been some volatility, fuel prices are also lower than the beginning of the year, said Andiswa Bata, FNB Business regional head - Gauteng South West.

"If implemented successfully, we should also see improved prospects for local businesses following the president’s economic reconstruction and recovery plan. The impact of Covid-19 does create a great deal of uncertainty for local businesses. As a result, it’s important for businesses to continue to manage costs, try to maintain a cash buffer and seek to offer the best possible products and services to customers, to protect revenue and defend market share," he said.