Trending

Elections 2024

Agribusiness confidence rebounds in Q3 of 2023

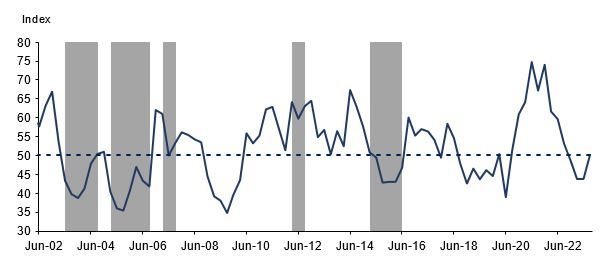

This improvement implies that agribusinesses are cautiously adapting to the challenging operating business conditions in the country emanating from the numerous long-standing challenges such as deteriorating infrastructure, failing municipalities, intensified geopolitical tension, and persistent episodes of load-shedding.

The readings above the neutral 50-point mark imply that agribusinesses are optimistic about business conditions in South Africa.

This survey was conducted between the last week of August and the first week of September, covering businesses operating in all agricultural subsectors across South Africa.

Figure 1: Agbiz/IDC Agribusiness Confidence Index

Discussion of the subindices

The ACI comprises ten subindices, and seven improved in Q3 2023. This excludes the debtor provision for bad debt and financing costs subindices, which are interpreted differently from other subindices. Here is the detailed view of the subindices.

• The turnover and the net operating income subindices are up by 9 and 4 points from Q2 to 74 and 59 in Q3 2023, respectively. Firms in the summer and winter grains, financial services and livestock mainly underpinned this optimism. The sentiment mostly mirrors the benefits of an ample agricultural harvest in the 2022/23 season.

• The market share of the agribusiness subindex is up two points from Q2 to 59. The respondents that mainly underscored this improvement were primarily in the summer and winter grains, while other subsectors maintained an unchanged view from the last quarter.

• The employment subindex lifted by 11 points from Q2 to 59. This optimism is unsurprising as the sector recently registered an improvement in jobs. For example, about 894,000 people were employed in primary agriculture in the second quarter, up 1% quarter-on-quarter and 2% year-on-year. This is the highest farm employment level since the last quarter of 2016 and is well above the long-term agricultural employment of 780,000.

• Surprisingly, the capital investments subindex increased by 19 points from Q2 2023 to 73. We suspect the sharp improvement in sentiment could be linked mainly to investment in renewables to cope with the intensified load-shedding. The data for other agricultural equipment, such as tractors and harvesters sales, has declined slightly in recent months.

• The general economic conditions subindex jumped by 16 points to 26. The recent positive growth figures for the year's second quarter perhaps influenced the sentiment.

• The general agricultural conditions subindex rose 8 points to 56 in Q3 2023. Favourable production conditions in the winter grains regions of the country mainly supported this increase. Still, there are growing concerns about the upcoming 2023/24 summer crop season due to the expected El Niño, although we suspect its impact will likely be mild.

• Unlike other positive subindices, the sub-index measuring the volume of export sentiment declined notably by 17 points to 43 in Q3 2023. This deterioration in sentiment signals the expected decline in export volumes this year from the robust levels of 2022, although the harvest is reasonably decent in all major crops and fruits. Ongoing worries about underperforming logistics could also be a cause for this pessimism.

• The subindices of the debtor provision for bad debt and financing costs are interpreted differently from the abovementioned indices. A decline is viewed as a favourable development, while an uptick signals growing financial strain.

In Q3 2023, the debtor provision for bad debt was up by 8 points to 41, which is unfavourable and signals a possible pressure in financing as businesses are possibly increasing borrowing to finance the alternative energy sources. Meanwhile, the financing costs indices fell by 1 point to 6, signalling that companies likely believe the interest rate hike cycle has ended.

The Agbiz/IDC ACI's Q3 results indicate a slightly upbeat mood after the past three-quarters of deterioration in sentiment. Still, the long-standing challenges of weakening municipalities, deteriorating roads, rising crime, inefficient logistics, and persistent load-shedding remain the major challenges that could undermine the sector's long-term growth.

These are aspects that both the government and private sector should collaboratively work to resolve to attract investments.