Marketing & Media trends

Industry trends

BizTrends Sponsors

Trending

#BizTrends2019: Rental growth cycles - what is in store for 2019?

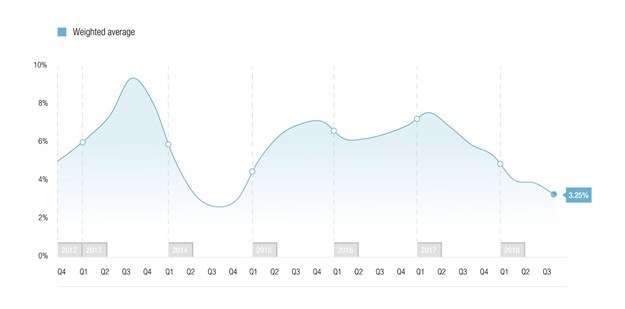

National rental growth

Nationally, we’ve seen a longer rental cycle than in individual provinces, mainly due to the influence of prolonged strong rental growth in the Western Cape. Most provinces have been experiencing cycles (measured from peak to peak or trough to trough) of around 6-12 quarters, whereas we’re seeing a national cycle in excess of 15 quarters.

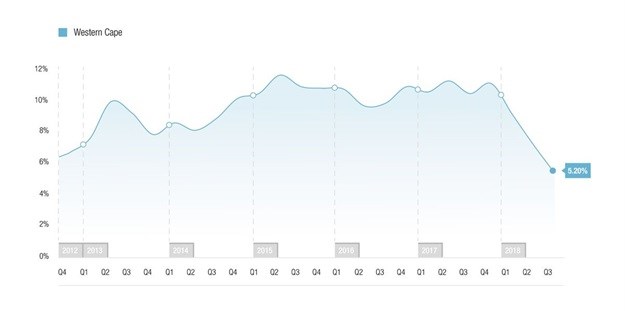

Western Cape correction

The Western Cape, once the darling of the rental sector, experienced growth of just over 5% in Q3 2018 – a long way from the 9%-10% that the province has grown used to. In fact, times have been so good that the Cape’s long-term rental growth skipped a “normal” downturn entirely.

A correction was certainly long overdue. However, we do expect rental growth to pick up again in the second half of 2019, though not to levels previously seen.

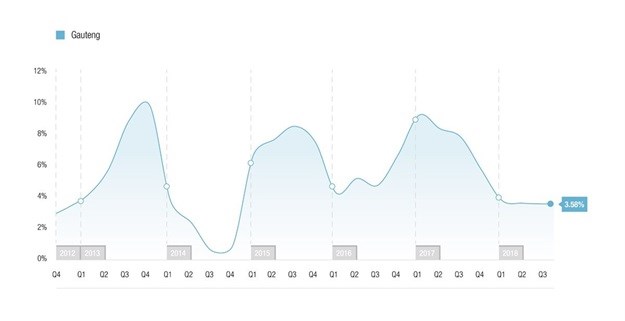

A turning point expected for Gauteng

By contrast, Gauteng has shorter rental cycles with clearer peaks and troughs. We expect to see rental growth recovery in the first half of 2019, after experiencing six consecutive quarters of declining growth in Q3 2018.

The rise of developer landlords

While we expect growth to pick up for these two provinces (as well as most others and nationally) in 2019, we don’t expect figures to reach levels previously seen, at least not in the short- to medium-term.

The reason for this is simple – supply is relatively inelastic. High rental and capital growth rates in major residential markets attract developers, who respond by building many units at once, effectively flooding the market with residential units. They then rent these units out below the going rate while achieving the same profit margin due to economies of scale and little to no commission cost. This has a huge impact on rental prices due to the volume of developer rental supply.

Quantity over quality

Lower rents are definitely attractive in the current economic climate, which is why many tenants opt to move to cheaper alternatives, often giving up “luxuries” such as premium service and personal relationships with their rental agents.

Added to this, high supply volumes and low rents from developer-landlords are hurting traditional estate agents, and will continue to do so in the year ahead.

The outlook? As long as there is oversupply in the market and demand plays catch-up, rental growth rates won’t return to the 6%-7% levels that were once the norm.